gopixa

Investing has actually gotten harder just recently. With rates increasing, inflation levels still above average, and the economy still growing at an anemic rate, markets have actually been extremely fluid considering that the pandemic hit almost 3 years back. Because markets have actually been rangebound for many of the last numerous years, index investing hasn’t been as effective, and lots of people are progressively relying on alternative investing techniques.

A kind of financial investment that has actually ended up being popular over the last years, in specific for earnings financiers, is concentrating on covered call funds. Among the more popular funds that utilized this option-based technique is the JP Morgan Nasdaq Equity Premium Earnings Exchange Traded Fund ( NASDAQ: JEPQ). JEPQ has actually provided financier overall returns of 11.82% considering that the fund’s creation in Might of in 2015. The S&P 500 provided overall returns of 9% to financiers throughout the very same time.

I last composed about JEPQ in Might of this year. I ranked the fund a hold mainly due to the fact that of the unsure financial and investing environment. I am updating my ranking to a buy in this short article today. I anticipate markets to be rangebound for a long time as the economy appears to still be slowing, although indications likewise recommend that a much deeper economic crisis is not likely. JEPQ allows financiers to get much of the advantage from the core big cap tech holdings that ought to exceed as the economy recuperates next year and the dollar most likely likewise compromises versus many significant currencies progressing. This fund is most likely to continue to exceed and have the ability to provide financiers strong earnings and general returns in the existing market environment for a long time in my view.

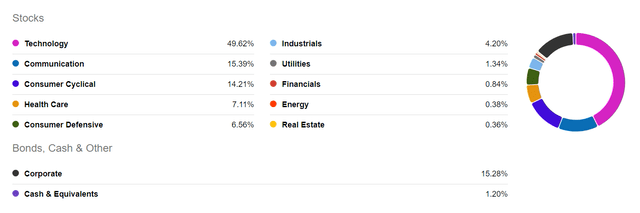

JEPQ loosely tracks the Nasdaq 100, which is clearly part of the general Nasdaq index. This ETF is less unpredictable than the Nasdaq 100 considering that the fund likewise has 7% of the fund’s possessions bought the healthcare sector, 6.56% in the customer protective sector, and 15.39% in the interaction sector. JEPQ is 49.62% bought innovation stocks. The fund’s leading 4 holdings are Apple ( AAPL), Amazon ( AMZN), Alphabet ( GOOG), and Microsoft ( MSFT). These 4 equities makeup 27% of the general portfolio.

A chart of JEPQ’s holdings ( Looking For Alpha)

JEPQ offers Equity-Linked Notes versus 20% of the fund’s portfolio and utilizes that earnings along with the dividends paid by the core holdings to make month-to-month circulations.

An Equity-Linked Note (‘ ELN’) is a financial obligation instrument, normally a bond, where the payment is based upon the hidden possession the choice is offered versus. The underlying equity of the ELN can be a collection of stocks, a single stock or an equity index. This fund offers one month out-of-the cash call alternatives versus the specific holdings along with the index, the Nasdaq 100. The earnings stemmed from offering the ELNs in addition to the dividends paid by the fund’s holdings allow this ETF to make month-to-month circulations.

JEPQ varies greatly from the Worldwide Nasdaq 100 Fund ( QYLD), due to the fact that this fund offers out of the cash calls versus just a few of the portfolio. QYLD offers at-the-money call alternatives versus all of the fund’s holdings every month. JEPQ carries out finest in a booming market environment with reasonably raised levels of volatility. The fund sells a few of the advantage of the equities, so extreme volatility levels can result in minimal upside in spite of extreme disadvantage threats.

JEPQ needs to carry out well and likewise continue to provide financiers strong earnings in what is most likely to be a rangebound market with an upward predisposition. Many financial indications reveal that although development has actually slowed substantially, the economy needs to have the ability to prevent a prolonged economic crisis. Inflation rates have fallen 11 of the last 12 months, the Fed is most likely near completion of the existing rate cycle, the task market stays steady, and individual cost savings levels are still above typical rates today for many families.

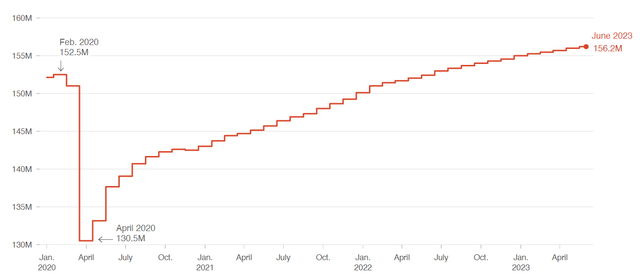

A chart of the labor market in the United States ( Bureau of Labor Data)

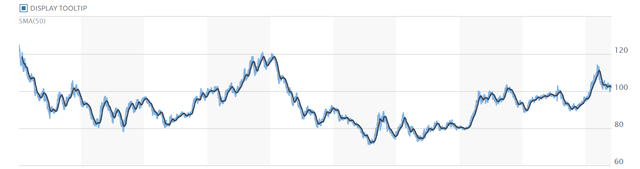

The dollar has likewise sold-off versus the Euro and most significant currencies considering that striking a 52-week high almost 6 months back.

A chart of the United States dollar versus the Euro ( Marketwatch)

The Nasdaq 100 is more leveraged to the dollar than many indexes considering that big cap tech business create almost 60% of their profits from beyond the United States. Wall Street likewise has a bullish outlook for huge cap tech in considerable part due to the fact that these business will deal with much easier year-over-year compensations for profits.

If the economy stays steady and big cap tech business continue to see strong profits, the marketplace needs to be rangebound with a small upward predisposition, and a fund such as JEPQ ought to exceed in this environment for numerous factors. This fund technique of offering out of the cash alternatives ought to not top the majority of the upside capacity for the portfolio, and the earnings this ETF is receiving from offering these month-to-month call alternatives ought to likewise more than offset any lost upside due to the fact that of the technique utilized by this covered call exchanged traded fund. Even with volatility levels most likely to decrease as worries of a wider economic crisis ease, the alternatives technique this fund utilizes ought to still provide good extra earnings in what I think is most likely to continue to be a flat to somewhat up market.

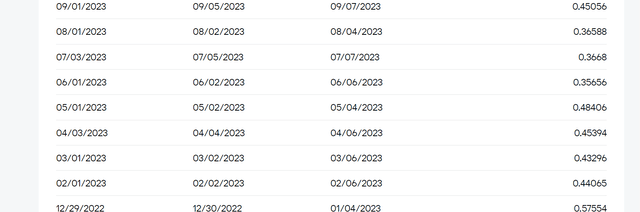

A chart revealing JEPQ’s current month-to-month payments ( JP Morgan)

JEPQ has actually paid strong earnings considering that the fund’s creation, and the typical month-to-month payment considering that the start of the year is almost $0.48 per share, which suggests the fund is on rate to pay almost 10% of the fund’s existing share rate in earnings.

All various sort of financiers have actually needed to get more imaginative in the more fluid market environment we have actually seen considering that the pandemic hit in 2020, however dividend financiers looking for to get inflation adjusted earnings have actually needed to make bigger modifications than many people. With inflation rates still above typical and the existing development rates most likely to continue to stay anemic, JEPQ needs to have the ability to continue to exceed the S&P 500 and the majority of the more comprehensive indexes for a long time in my view.