nevarpp

As we kept in mind in a tweet today, rate action of United States equities has actually been turned from Tuesday with big caps suffering bigger losses than little caps.

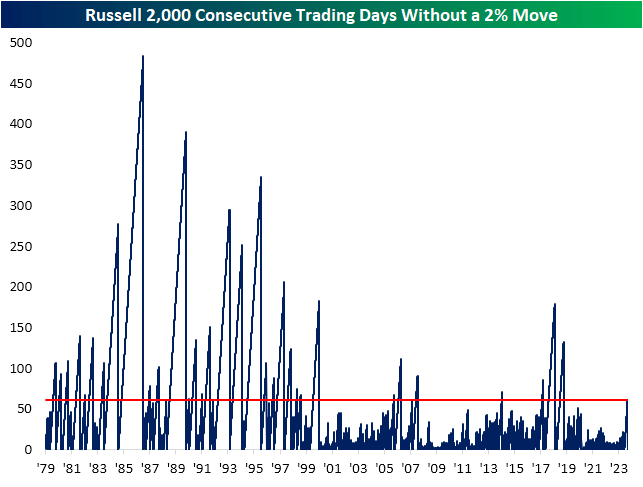

Taking a look at the other day, the decrease in the Russell 2000 (-2.1%) overshadowed the S&P 500’s (-0.4%). For the little cap Russell 2000, that marked the very first day-to-day relocation of a minimum of 2% (favorable or unfavorable) considering that June 5th when the index rallied 2.4%.

As revealed listed below, that three-month stretch without a day-to-day relocation of 2% is far from the longest on record, however it does stick out as one of the biggest in a long time. Running for 61 trading days, it was the longest considering that the 133-day streak ending on 10/9/18.

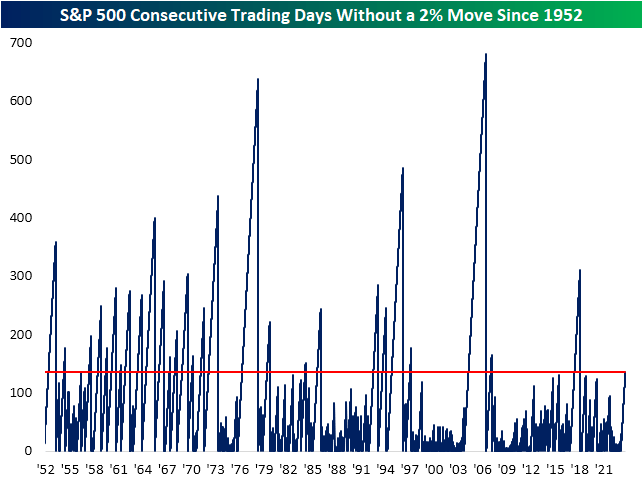

As formerly pointed out, today’s rate action is a little the reverse of Tuesday, nevertheless, the S&P 500 is far from a 2% drop of its own. In reality, the S&P 500 has actually been on an even longer streak without a 2% day-to-day relocation.

At 136 trading days, the present streak ranks as the longest considering that February 2018 (310 days). Similar to the Russell, the present streak would have a long method to go to reach records that lasted for several years like from 2003 to 2006.

Regardless, the reality of the matter is that everyday volatility by this step has actually been very soft of late.

Editor’s Note: The summary bullets for this short article were picked by Looking for Alpha editors.