{“page”:0,” year”:2023,” monthnum”:9,” day”:18,” name”:” balancing-high-yield-and-growing-dividends-in-a-sector-neutral-framework-with-the-sp-sector-neutral-high-yield-dividend-aristocrats”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Analyst, Strategy Indices”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”},{“display”:”Narottama Bowden”,”title”:”Director, Sustainability Indices Product Management”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”}]

Stabilizing High Yield and Growing Dividends in a Sector-Neutral Structure with the S&P Sector-Neutral High Yield Dividend Aristocrats

In September 2022, S&P DJI was pleased to include the S&P Sector-Neutral High Yield Dividend Aristocrats ®(* )to the S&P Dividend Aristocrats Index Series. While many dividend indices have noteworthy sector under- and overweights versus their hidden standard, this index is the very first in the series to be sector neutral. As such, this index stresses dividend development and high yield while keeping the exact same sector weights as its standard, the S&P Composite 1500 ® In this blog site, we will evaluate the method of this index and discuss how it might act as a more well balanced dividend development technique that is more carefully lined up with its standard. Exhibition 1 sums up the method building and construction of the S&P Sector-Neutral High Yield Dividend Aristocrats. A trademark of the S&P Dividend Aristocrats Indices is the dividend development requirement, which normally needs constituents to raise their overall dividend per share every year for a minimum variety of years. To help with sector-neutrality in this index, the minimum was set at 7 years of steady or growing dividends. This limit guarantees that adequate constituents from each sector certify, while integrating a number of the wanted attributes of a dividend development technique.

Business that fulfill the dividend development requirement should likewise have an indicated yearly dividend (IAD) yield that is higher than the sector mean yield. Constituents are weighted by float market cap (FMC) within the GICS

®(* )sectors. To integrate sector-neutrality, the index changes the sector weights to mirror the sector weights of the S&P Composite 1500. As Exhibition 2 programs, the index’s outright efficiency versus the standard has actually been practically similar considering that its very first worth date (Jan. 31, 2005). Notably, nevertheless, the S&P Sector-Neutral High Yield Dividend Aristocrats has actually shown lower volatility relative to the standard, causing exceptional risk-adjusted returns. In addition, the optimum drawdown over the duration was roughly 5% lower. As Exhibition 3 programs, the index’s dividend yield has actually been bigger than the S&P Composite 1500 every year considering that 2005. In addition, the typical dividend yield for the S&P Sector-Neutral High Yield Dividend Aristocrats was 3.02% versus 1.86% for the standard over the exact same duration. The considerable uptick in dividend yield is a favorable outcome of the index just picking constituents whose IAD yield is higher than the sector mean IAD yield.

As Exhibition 4 programs, the index has actually traditionally offered disadvantage security relative to the S&P Composite 1500, showing an 86.5% disadvantage capture ratio. This metric supports the idea that the S&P Dividend Aristocrats method supplies stability considering that the capability to regularly preserve or grow dividends every year through various financial environments can be an indicator of monetary strength and discipline.

Exhibition 5 highlights the substantial resemblance in sector weights due to the sector-neutral method carried out in the method. Little variances in sector weights can be anticipated due to constituent efficiency within the sectors in between reweightings.

Historically, the S&P Sector-Neutral High Yield Dividend Aristocrats has actually had similar returns and sector weights relative to its standard, while likewise offering boosted dividend yields and disadvantage security. For financiers looking for a well balanced dividend technique focused both on dividend development and yield, the S&P Sector Neutral High Yield Dividend Aristocrats is an engaging choice to think about.

The posts on this blog site are viewpoints, not guidance. Please read our

Disclaimers

Evaluating Active in Australia: Lessons from the SPIVA Australia Mid-Year 2023 Scorecard

Anu Ganti

Senior Director, Index Financial Investment Method

-

Fixed Earnings

Tags 2023, -

active management,

Anu Ganti, Australia FA, Australian bonds, Australian equities, set earnings, worldwide equities, S&P Australia Financial Investment Grade Corporate Bond Index, S&P Established Ex-Australia LargeMidCap, S&P/ ASX 200, S&P/ ASX Australian Fixed Interest 0+ Index, SPIVA, SPIVA Australia Considering That 2013, our SPIVA ®(* )Australia Scorecards have actually revealed that most of actively handled Australian equity funds have actually normally underperformed the

S&P/ ASX 200 According to the just recently released SPIVA Australia Mid-Year 2023 Scorecard, 55% of Australian Equity General fund supervisors lagged the S&P/ ASX 200 in the very first half of 2023. Outcomes for some fund classifications were bleaker, with 74% of International Equity General fund supervisors underperforming the S&P Established Ex-Australia LargeMidCap in the very first half of 2023. We can utilize

design predisposition, which plays a significant function in discussing active supervisor outperformance, to disentangle this combined set of outcomes. For instance, in our SPIVA report, we discovered that domestic equity supervisors might have gained from direct exposure to abroad markets, which have actually surpassed Australian big caps up until now this year. Nevertheless, design predisposition can be a double-edged sword, as Australian worldwide equity supervisors may have dealt with headwinds from the outperformance of the U.S. relative to other worldwide markets. In Australian dollar terms, the S&P 500 ®(* )surpassed the

S&P Established Ex-U.S. LargeMidCap 1 by 5% over the six-month duration ending in June. This is a moderate degree of relative strength by historic requirements, as we observe in Exhibition 1: 2013, 2014, 2016 and 2021 were years of considerable U.S. outperformance in which, maybe not coincidentally, we likewise reported the greatest worldwide active fund underperformance rates of any SPIVA report, recommending a possible aggregate underweight to U.S. equities relative to the standard. 2 On The Other Hand, Australian Mutual funds carried out reasonably much better than their large-cap equity equivalents, with a bulk outperformance of 55%. Once again, maybe venturing beyond Australia to acquire credit direct exposures played a beneficial function. Exhibition 2 highlights that active Australian Mutual funds have actually tended to outshine when worldwide domiciled or provided Australian dollar-denominated business bonds of comparable credit quality have actually carried out well relative to their in your area provided peers. Since mid-year 2023, the S&P Australia Financial Investment Grade Corporate Bond Index surpassed the standard S&P/ ASX Australian Fixed Interest 0+ Index

by 1%. Design predispositions been available in lots of types and can assist discuss the possibility of active outperformance throughout both equities and set earnings markets. Comprehending these predispositions and identifying them from real security choice ability might supply important insights for Australian property owners when making supervisor choice choices. The author wishes to thank Grace Stoddart for her contributions to this post. 1

S&P Established Ex-U.S. LargeMidCap had a 6% weight in Australia since August 31, 2023.

2

S&P Established Ex-Australia LargeMidCap had a 68% weight in the U.S. since August 31, 2023.

The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers

Classifications

Equities, Fixed Earnings Tags

Disclaimers

2023,

-

Cristopher Anguiano,

Index Building And Construction, -

infotech,

S&P 1000, S&P 500, S&P 500 Infotech, S&P 500 Leading 50, S&P 900, S&P Composite 1500, S&P MidCap 400, S&P SmallCap 600, S&P U.S. Equity Indices, Design, U.S. Equities, United States FA Following a difficult 2022, H1 2023 hosted a healing amongst U.S. equities: the S&P 500 ® (up 16.9%) published its fourth-best very first half considering that 1996, and there were gains throughout the marketplace cap spectrum. However on a relative basis, and in contrast to longer horizons, the S&P Core U.S. Equity Indices lagged their CRSP equivalents in H1 2023 (see Exhibition 1). The notified reader understands that 2023 has actually been a strong year for mega caps and Infotech business. Undoubtedly, the

S&P 500 Infotech (42.8%) and S&P 500 Leading 50

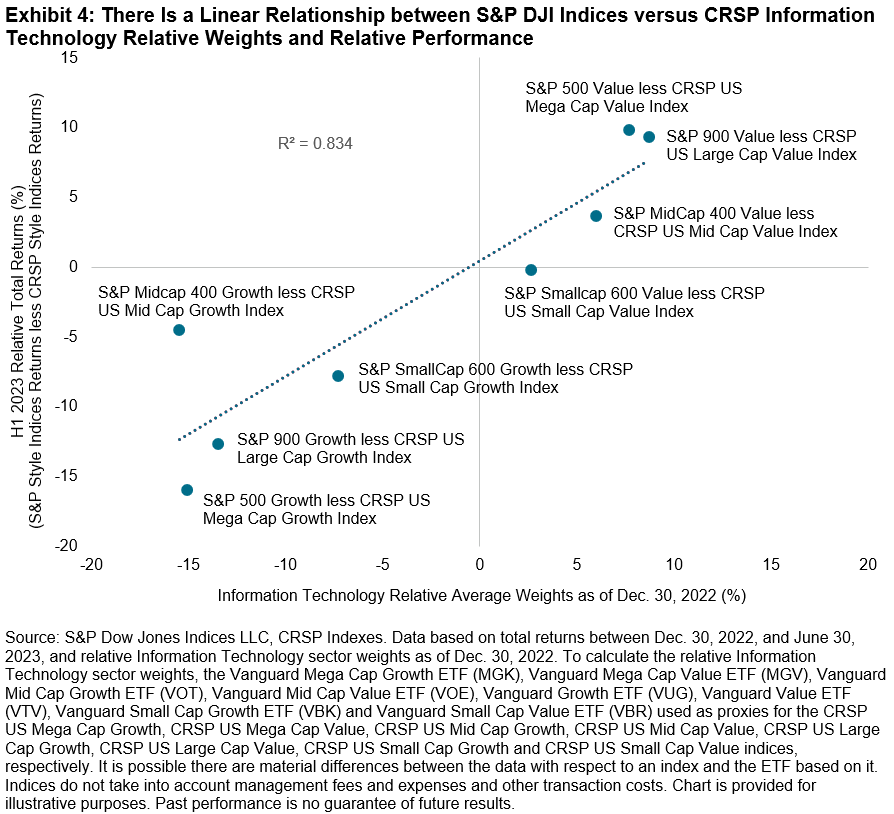

(27.6%) published their finest first-half efficiency considering that 1996 (see Exhibition 2). Considered That S&P DJI’s indices took advantage of having less direct exposure to Infotech in 2022, one may anticipate this assisted to discuss relative efficiency in H1 2023. Exhibition 3 shows that the S&P 500’s relative efficiency in H1 2023 was impeded by its lower weight in Infotech. The Brinson attribution results program that less direct exposure to the Infotech sector contributed adversely to the S&P 500 (-0.6%). Integrated with the unfavorable choice result in Infotech (-0.6%)– the S&P 500 and the CRSP United States Mega Cap Index (as represented by the Lead Mega Cap Index Fund as a proxy) have various constituents owing to distinctions in index building and construction– most likely around 50% of the S&P 500’s underperformance was credited to Infotech. The repercussions of Infotech weight were a lot more evident throughout design indices: Exhibition 4 reveals that S&P Design Indices with more (less) direct exposure to Infotech out- (under-) performed their CRSP equivalents in H1 2023. For instance, the S&P 500 Worth and

S&P 900 Worth

published their finest relative H1 returns over the last ten years, beating their CRSP equivalents by 9.9% and 9.3%, respectively. On the other hand, the S&P 500 Development and S&P 900 Development published their worst relative H1 returns over the exact same duration, lagging their CRSP equivalents by 15.9% and 12.6%, respectively. Different CRSP index-based ETFs are utilized as proxies for the CRSP indices listed below. The very first half of 2023 when again highlighted the significance of index building and construction when examining index attributes, offered various direct exposures can assist to discuss efficiency distinctions in between indices with comparable sounding goals. The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers

Tags

2023, Cristopher Anguiano, Index Building And Construction,

diversity,

-

vibrant allotment,

equity futures, -

Repaired Indexed Annuities,

insurance coverage, long treasury futures, multi-asset, danger control, S&P 500 Duo Swift Index, S&P 500 e-mini futures, brief treasury futures, treasury futures How is intraday volatility rebalancing assisting brand-new multi-asset indices quickly react to altering markets? Look inside the S&P 500 Duo Swift Index, a varied, multi-asset, risk-controlled index that is vibrant by style. https://www.youtube.com/watch?v=YEo6_OiP474 The posts on this blog site are viewpoints, not guidance. Please read our