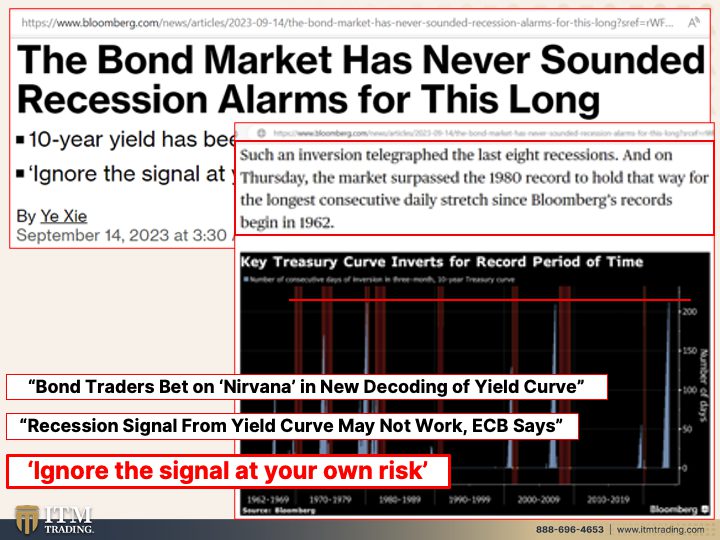

The number of extraordinary financial difficulties must we deal with prior to the general public acknowledges the intensity of the scenario? The bond market remains in mayhem and we are presently seeing the longest taped Yield Curve Inversion. When you include the loss of trustworthiness our Reserve bank is experiencing in the Markets and the unusual Triple Leading in Gold costs over the last 3 years, it’s ill-advised to overlook these indication.

CHAPTERS:

0:00 Yield Curve Inversion

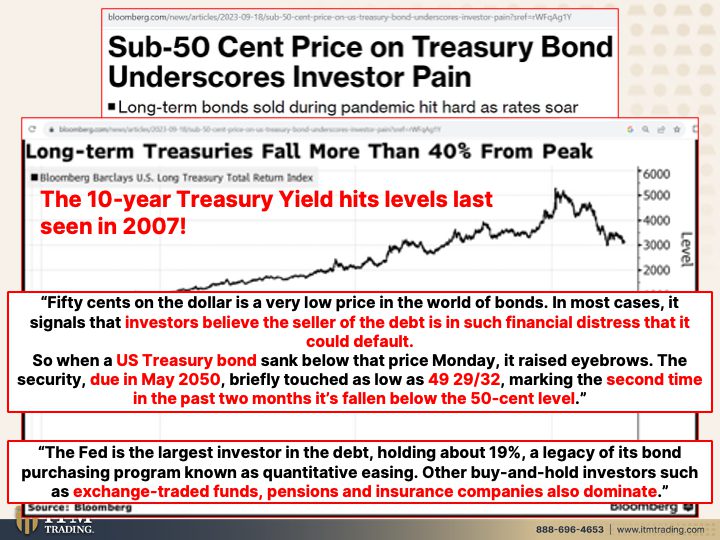

2:01 Bond Market

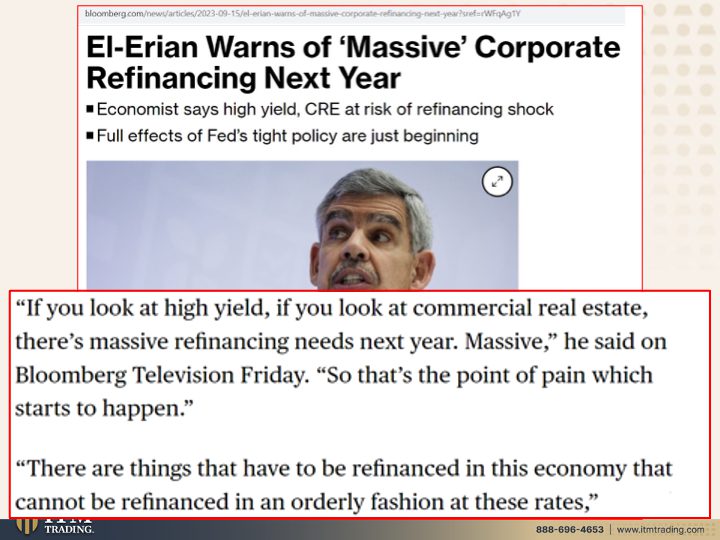

4:41 Huge Business Refinancing

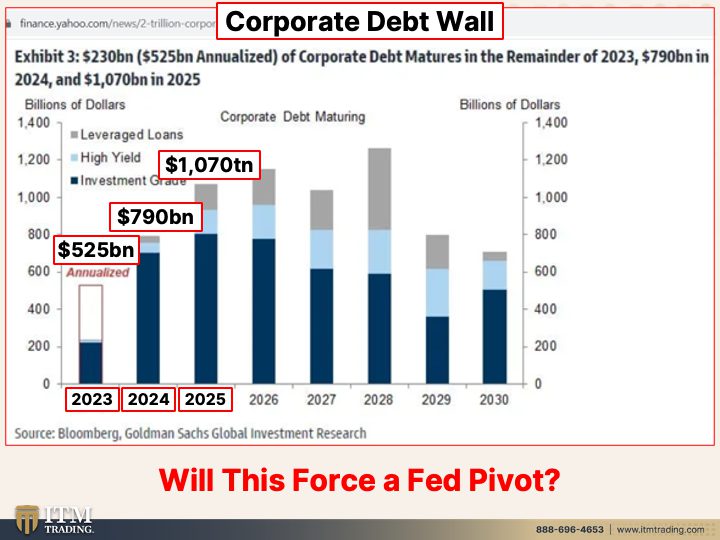

6:59 Business Financial Obligation Wall

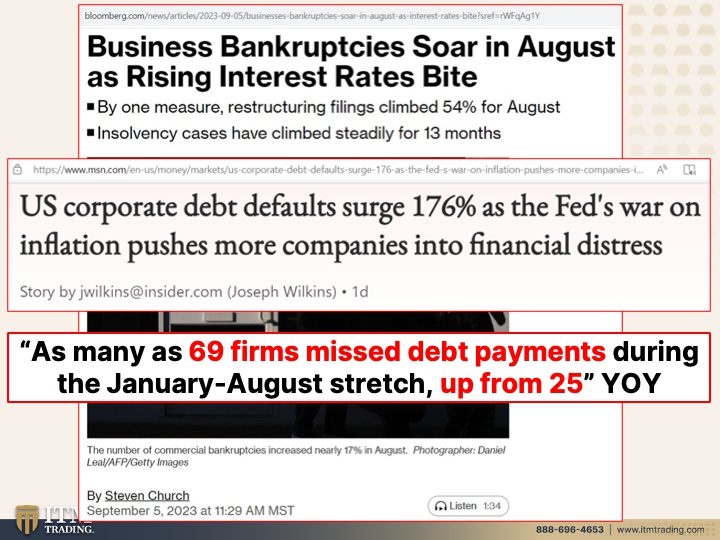

8:32 Bankruptcies & & the Fed

12:25 Fed’s Rate Order

13:51 Fifty Cents on the Dollar

19:23 Federal Government Shutdown

20:29 Triple Leading

23:20 Construct a Neighborhood with United States!

SLIDES FROM VIDEO:

SOURCES:

The Bond Market Has Actually Never Ever Sounded Economic Crisis Alarms for This Long– Bloomberg

Bond Traders Bet on ‘Nirvana’ in New Decoding of Yield Curve– Bloomberg

Economic Crisis Signal From Yield Curve Might Not Work, ECB States– Bloomberg

https://finance.yahoo.com/news/2-trillion-corporate-debt-wall-042143808.html

Fed’s Higher-for-Longer Mantra Has Skeptics in Bond Market– Bloomberg

World Adapts to Fed’s Rate Order in 36-Hour Series– Bloomberg

https://www.xe.com/currencycharts/?from=XAU&to=USD&view=10Y

https://www.fidelity.com/learning-center/trading-investing/are-we-in-a-recession