{“page”:0,” year”:2023,” monthnum”:9,” day”:13,” name”:” the-case-for-timber”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Analyst, Strategy Indices”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”},{“display”:”Narottama Bowden”,”title”:”Director, Sustainability Indices Product Management”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”}]

The Case for Wood

Wood is a vital resource and an authentic foundation of human civilization. Its usage in structure construction and as a fuel source have actually made it important to the performance of our societies and world economy. On the other side, our reliance on lumber, integrated with a prolonged regrowth time, indicates we are gradually consuming this important resource. In the pre-industrialized world, forests covered more than 50% of habitable land. 1 Today, our growing need for this resource has actually minimized this protection to less than 40%.

Trading of timber-linked items has actually seen huge development in the previous years. 2 This hunger for lumber is anticipated to grow a lot more in the coming years. 3 Although domestic need stays the crucial chauffeur for lumber, other usage cases like paper, product packaging, plywood, and so on, assistance need variety for lumber. 4

Purchasing Wood

Wood is a genuine property and investing in it normally includes ownership of the arrive on which the lumber-producing trees grow. Wood, being a physical property, offers your common inflation security element, however, unlike lots of other genuine possessions, has the distinct function of biological development throughout times of volatility and depressed need. 5 The choice of versatile timing of harvests throughout low need can ravel a few of the rate volatility of lumber financial investments. Price quotes put almost 60% of the forestlands in the U.S. as independently owned. 6

Capital allowance to lumber producing forestlands has actually typically been within the world of big institutional financiers that straight own the forestlands and can utilize intermediaries (e.g., Forest Financial investment Management Organizations [TIMOs]) to handle these lands. Knowledge in forestry and land management, integrated with reasonably long hold-up durations and illiquidity, have actually been leading chauffeurs for active management of these possessions. Nevertheless, Forest REITs bring the very same competence in management of forests and are openly traded, offering relative liquidity, real-time prices and openness for these long-dated possessions. Furthermore, ETFs likewise supply another opportunity of access to lumber and associated financial investments by means of openly traded instruments.

The push towards sustainability as a financial investment objective includes another measurement to lumber’s worth in a varied portfolio. Effective water/soil/resource management, ecosystem/biodiversity conservation and favorable environment effect all add to beneficial ecological and sustainability goals. Forests serve as a carbon sequestration system, and when lumber from these forests is utilized in building and construction, this can even more minimize GHG emissions. 7

Indexing Technique to Timber-Related Investments

The S&P Global Wood and Forestry (GTF) Index, introduced in 2007, targets direct exposure to timber-related financial investments by means of public equity stocks throughout industrialized market listings and regional listings from 3 emerging market nations (Brazil, South Korea and South Africa).

S&P GTF Index constituents cover the worth chain of the lumber environment. To record a broad investable stock group with thematic importance, the beginning universe of stocks consists of companies from Wood REITS under the GICS ®(* )category, 8 in addition to companies whose earnings originates from sections appropriate to the forestry organization (utilizing the FactSet Revere Company Market Category System). A direct exposure rating structure is used over this group of stocks to keep the index’s thematic pureness. Companies with greater direct exposure ratings are typically viewed as being closer to the core of the lumber producing and processing environment. Wood REITs and Wood Residential or commercial property Management stocks are offered a greater direct exposure rating, in addition to pulp mills that can be vertically incorporated, when compared to Paper Mills and Product packaging Products associated business that are more downstream. The index constituents’ weights are based upon each stock’s direct exposure rating and its float market capitalization, based on suitable restrictions to prevent concentration threat.

Furthermore, the index approach leaves out business that are taken part in particular organization activities (e.g., questionable weapons, tobacco items, and so on) and business that are non-compliant with the United Nations Global Compact (UNGC) standards, and it evaluates business for any reputational threat issues.

Since Aug. 30, 2023, the index includes 30 stocks, with 43% weight designated to 11 pure-play business, 16% weight in Wood REITs stocks and 27% weight to the business with a direct exposure rating of 1.

The index is slanted (56%) towards mid-cap stocks (see Exhibition 2), with the bulk (over 40%) of the direct exposure originating from North American entities, followed by European companies (33%).

1

https://www.visualcapitalist.com/visualizing-the-worlds-loss-of-forests-since-the-ice-age/ 2

https://www.worldwildlife.org/industries/timber 3

https://www.marketwatch.com/press-release/forestry-and-logging-market-2023-to-2029-projected-to-flourishing-hancock-victorian-plantations-weyerhaeuser-scottish-woodlands-tilhill-forestry-2023-06-16 4

https://caia.org/blog/2023/02/25/exploring-link-between-lumber-prices-and-timber-markets 5

https://www.ipe.com/inflation-assets-timber/37666.article 6

https://cdnsciencepub.com/doi/10.1139/cjfr-2021-0085 7

https://www.fs.usda.gov/research/treesearch/63853 8

For additional info please see the S&P Thematic Indices Method The posts on this blog site are viewpoints, not recommendations. Please read our

Disclaimers S&P U.S. Indices H1 2023: Examining Relative Go Back To Russell

Fei Wang

-

Equities

Tags -

2023,

core, Fei Wang, development, Index Building, infotech, S&P 500, S&P 500 Development, S&P 500 Worth, S&P Core Indices, S&P Development Indices, S&P MidCap 400, S&P SmallCap 600, S&P Design Indices, S&P Worth Indices, Design, U.S. Equities, U.S. little caps, United States FA, worth After a tough year in 2022, the U.S. equity market saw a strong turn-around in the very first half of 2023, with the

S&P 500 ®(* )up 17% given that year-end 2022. Exhibition 1 reveals that the rebound was likewise observed throughout the cap spectrum. Returns in the 2nd quarter outshined the very first quarter after the marketplace got rid of local bank issues previously this year. The S&P Core Indices typically underperformed their Russell equivalents in H1 2023. The big- and small-cap indices, in specific, saw reasonably big distinctions. For example, the S&P 500 underperformed the Russell Top 200 by 2.53% in H1 2023, its 2nd biggest H1 underperformance given that 1995, just 2020 was bigger (-2.59%). The S&P 500’s underperformance appears to have actually been mainly driven by having less direct exposure to Infotech, which has actually been running hot up until now this year. However there were other possible factors to consider even more down the cap spectrum. For instance, the

S&P SmallCap 600

®‘s H1 2023 underperformance might have been driven by the option of constituents– especially in Healthcare and Financials– instead of distinctions in sector direct exposures (see Exhibition 3). The various chauffeurs of relative efficiency throughout the cap spectrum have when again showed the significance of index building and construction and possible effect of stock choice and size direct exposure s. There was likewise raised divergence amongst design indices in H1 2023. The S&P Worth Indices outshined their Russell equivalents throughout the cap spectrum, while the S&P Development Indices underperformed. Especially, the S&P 500 Design Indices published the biggest H1 efficiency differentials compared to Russell equivalents given that 1995– the S&P 500 Worth

outshined the Russell Top 200 Worth by 7.2%, while the S&P 500 Development underperformed by 10.9%. Relative direct exposure to Infotech assisted to discuss the relative efficiency in between S&P DJI and Russell Design Indices. Certainly, Exhibition 5 reveals that design indices with greater direct exposure to the Infotech sector outshined in H1 2023. This was especially the case considered that S&P DJI’s December 2022 design reconstitution resulted in some sector shifts

: S&P 500 Worth (Development) had more (less) direct exposure to Infotech sectors than its Russell equivalent. Numerous Russell index-based ETFs are utilized as proxies for the Russell indices listed below. The very first half of 2023 saw a healing amongst U.S. equities. Infotech direct exposure was very important in describing the relative efficiency of the S&P 500 and S&P Design Indices compared to their Russell equivalents. However stock choice and the size aspect likewise contributed in mid- and small-cap indices. As soon as once again, such efficiency distinctions highlight the significance and possible effect of index building and construction. 1

We utilized the following ETFs as proxies for the Russell indices:

iShares Russell Top 200 Development ETF, iShares Russell Top 200 Worth ETF, iShares Russell MidCap Development ETF, iShares Russell MidCap Worth ETF, iShares Russell 2000 Development ETF, iShares Russell 2000 Worth ETF, iShares Russell 1000 Development ETF and iShares Russell 10000 Worth ETF

The posts on this blog site are viewpoints, not recommendations. Please read our

Disclaimers

Tags 2023,

Senior Expert, U.S. Equity Indices

-

Tags

2023, -

DJICS,

Dow Jones Market Category System, Dow Jones U.S. Select Insurance Coverage Index, Dow Jones U.S. Select Sector Specialized Indices, insurance coverage, sector, Sherifa Issifu, subsector, U.S. Equities, United States FA The worldwide insurance coverage market capitalization has actually grown considerably over the previous 3 years, growing from almost USD 350 billion at the end of 1992 to USD 2.7 trillion since H1 2023. This development was accompanied by a shift in worldwide management. For instance, Exhibition 1 reveals that European insurer comprised a higher percentage of the insurance coverage market than their U.S. equivalents in the early 1990s. Nowadays, the U.S. represent most of the marketplace capitalization, while Europe’s weight has actually decreased. The

Dow Jones U.S. Select Insurance Coverage Index

catches an investable part of the world’s biggest insurance coverage market. Similar to other indices in the Dow Jones U.S. Select Sector Speciality Index Series, the index is developed to determine the efficiency of chosen subsectors of the Dow Jones Market Category System (DJICS) Constituents need to likewise satisfy liquidity and market capitalization limits. The index utilizes a float-adjusted market capitalization (FMC) weighting plan with some top-level diversity topping guidelines used and is rebalanced quarterly in March, June, September, and December. 1 The Dow Jones U.S. Select Insurance coverage Index consists of stocks from the Dow Jones U.S. Broad Stock Exchange Index

that are categorized under DJICS as Complete Line Insurance Coverage, Residential Or Commercial Property & & Casualty Insurance Coverage and Life Insurance Coverage, and leaves out business whose primary organization activities are categorized as Reinsurance and Insurance Coverage Brokers. Exhibition 2 reveals that Residential or commercial property & & Casualty Insurance coverage is the main subsector, comprising 67% of the index since June 30, 2023, followed by Life Insurance coverage at 24% and Complete Line Insurance coverage as the tiniest piece at simply 10%. Insurer are normally thought about non-cyclical or “protective” considered that the product or services offered by insurer are frequently required despite the stage of business cycle. The historic efficiency of the Dow Jones U.S. Select Insurance coverage Index appears to show this point of view. Exhibition 3 reveals that, while the Dow Jones U.S. Select Insurance coverage Index published comparable efficiency to the Dow Jones U.S. Broad Market Index given that completion of 1991 (an annualized 9.5% vs 9.9%, respectively), the insurance coverage index outshined in rough environments. For instance, the broad market decreased by 19% in 2022, while the Dow Jones U.S. Select Insurance coverage Index got 12%, surpassing by 31%. In H1 2023, the insurance coverage index underperformed, as tech stocks moved the marketplace greater.

The Dow Jones U.S. Select Insurance coverage Index normally had a lower tracking 12-month P/E ratio than the Dow Jones U.S. Broad Stock Exchange Index, suggesting market individuals normally paid less for every single dollar of incomes got. The index likewise had a reasonably greater recognized dividend yield than the Dow Jones U.S. Broad Market Index, revealing that insurer paid more dividends relative to their share rate.

1

For additional information, please see the

Dow Jones U.S. Select Sector Speciality Indices Method The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Tags 2023,

Senior Director, Head of Products and Genuine Possessions

S&P Dow Jones Indices

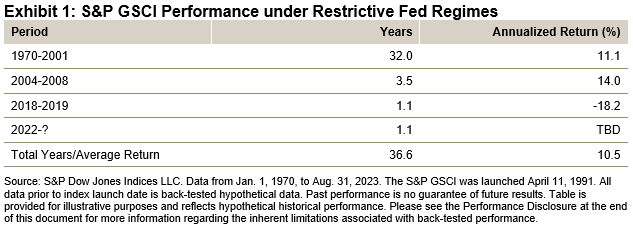

I enjoy this time of year. August holidays are over, the kids are back in school and football season begins in the U.S. The Fed took its August “trip” at the Jackson Hole Seminar, where Jerome Powell’s remarks singularly concentrated on rate stability. Inflation has actually boiled down however “stays expensive” and the Fed alerted it’s “prepared to raise rates even more.” As markets get ready for ongoing limiting financial policy, we returned to school to examine the efficiency of products under a limiting Fed. Because 1970, the

S&P GSCI

has actually attained typical annualized returns of 10.5% compared to simply under 1% throughout durations when the Fed kept a limiting policy position. As part of its double required, the Fed sets a target inflation rate of 2%. While that procedure stays approximate, the Fed looks for to accomplish this through accommodative or limiting financial policy. Utilizing the main tool of the Fed, we compare the efficiency of the S&P GSCI when the Fed funds efficient rate stays above target inflation for a minimum of 12 months. The S&P GSCI is the leading product standard, with back-tested history extending for over 50 years. Taking this renowned standard, we examine index efficiency throughout this time. There have actually each been 3 durations where continual financial policy was either limiting or accommodative, covering 50 of the 53 years given that 1970. In over two-thirds of the sample, typical annualized returns were over 10.5%. This covers the inflationary bouts of the 1970’s, the product incredibly cycle of the 2000’s and one especially brief and abysmal year in 2018/2019. Financiers of product ETFs missed out on these chances, with the introduction of the product ETF’s happening throughout incredibly loose financial policy routines. Inflation is now the focus of the Fed and product efficiency has actually gotten.

Charting the present Fed funds efficient rate advises me of Mr. Powell’s view of the Grand Tetons. These towering peaks pierce the Wyoming sky, with a rugged shape going for 40 miles. The greatest peak tops 13,775 feet, while the most affordable elevation is well over a mile high. Those peaks rest on leading the 3,000 mile long Rocky Mountains with elevations over one and approximately 3 miles high. Like the Tetons, inflation has actually stuck out up and fell from its current peak however stays raised. This would discuss Mr. Powell’s focus on inflation, specifying “limiting financial policy will likely play a progressively essential function.”[1]

Taking a look at the history of the S&P GSCI, when the Fed gets protective, products have actually tended to be an excellent offense. In this present duration of limiting financial policy, products have actually produced strong however unpredictable returns. The S&P GSCI attained a 22% return in 2022, surpassing all property classes. Year-to-date, the S&P GSCI has an overall return over 5%. Must the Fed stay limiting, historic product returns have actually shown to be a strong protective method.

The 3 years consist of the present duration and times the efficient rate did not remain above or listed below for a minimum of twelve successive months.

The posts on this blog site are viewpoints, not recommendations. Please read our

[1] Disclaimers

S&P 500 Low Volatility Index August 2023 Rebalance The

S&P 500 ®(* )carried out well from the last rebalance for the

S&P 500 Low Volatility Index on May 19, 2023, through the most current rebalance on Aug. 18, 2023. As Exhibition 1 reveals, the S&P 500 was up 4.7% throughout this duration versus a decrease of 1.5% for the S&P 500 Low Volatility Index. This divergence tends to take place specifically throughout durations of strong efficiency and low volatility for the S&P 500. Surprisingly, the annualized everyday basic discrepancy over this duration for the S&P 500 was a reasonably low 10.7%. As Exhibition 2 programs, tracking 1 year volatility reduced for all 11 GICS ® sectors since July 31, 2023, versus April 28, 2023. Determined in outright terms, volatility reduced the most for the Customer Discretionary and Energy sectors, which fell 6.8% and 5.4%, respectively. Since July 31, 2023, Energy, Interaction Providers, Customer Discretionary, Infotech and Realty were the leading 5 most unstable sectors in the S&P 500, with everyday recognized volatilities of around 29%, 27%, 26%, 26% and 23%, respectively. In the middle of the total reduction in volatility, the S&P 500 Low Volatility Index’s newest rebalance brought some modifications to sector weights. The current rebalance moved an extra 1.5% weight to the Customer Staples sector, which even more strengthened its position as the biggest sector by weight. Energies had the biggest decrease in weight, at around 2.9%, dropping it to the third-largest sector by weight. The Customer Staples, Utilities, Healthcare, Financials and Industrials sectors continued to have a combined weight of higher than 90%. Energy and Products continued having no weight in the S&P 500 Low Volatility Index. The current rebalance worked after the marketplace close on Aug. 18, 2023.

The posts on this blog site are viewpoints, not recommendations. Please read our

Disclaimers