Weekly highlights

- Asia-US West Coast rates (FBX01 Weekly) reduced 5% to $ 1,778/ FEU

- Asia-US East Coast rates ( FBX03 Weekly) fell 8% to $ 2,650/ FEU

- Asia-N. Europe rates ( FBX11 Weekly) fell 34% to $ 996/FEU

- Asia-Mediterranean rates ( FBX13 Weekly) fell 4% to $ 1,751/ FEU

- China– N. America weekly rates increased 4% to $ 4.41/ kg

- China– N. Europe weekly rates increased 7% to $ 3.70/ kg

- N. Europe– N. America weekly rates increased 1% to $ 1.67/ kg

Dive much deeper into freight information that matters

Remain in the understand in the now with immediate freight information reporting

Analysis

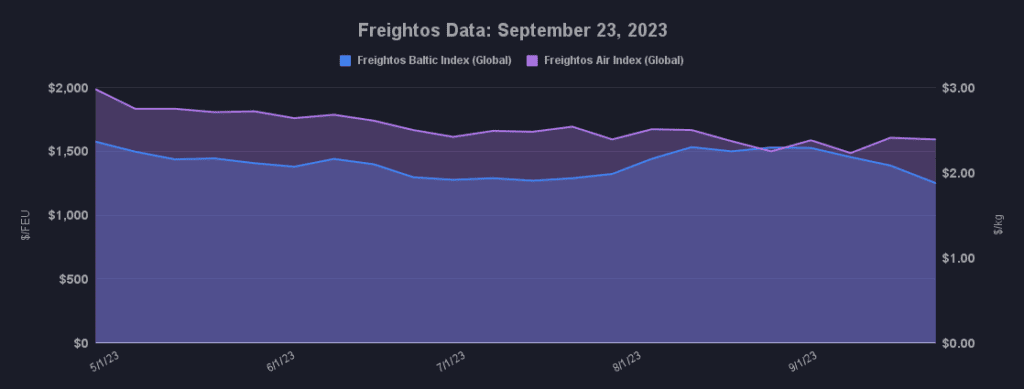

Recently, transpacific ocean rates continued their slide that began early this month. As today’s rates have actually continued to decrease, rates are now 17– 20% lower than at the end of August. Moving rates and reports of increased blanked cruisings revealed through October, most likely signal that this year’s peak volumes lag us.

Rates, and most likely volumes too, are falling regardless of United States customer costs on products staying constant in August. A current analysis recommends that some costs development is on the kinds of products, like computer game, that do not deliver by ocean container– another consider the relative detach in between costs and freight.

However even with the rate decreases of the last couple of weeks, rates to the West Coast stay well above 2019 levels, and East Coast rates have to do with even with 2019. Taken together with reports that usage levels are over 90% to the West Coast, however closer to 80% to the East Coast, area rates still above agreement levels and most likely above break-even mean providers– in the meantime– are handling transpac capability effectively.

Providers will look for to keep vessels complete and rates from falling excessive in the coming weeks through even more blanked cruisings and service suspensions– jobs that will just get more tough as volumes ease and record levels of brand-new capability, about one vessel each day for the remainder of the year, will continue to get in the international market.

Providers are not having the very same success on Asia– Europe lanes where rates crashed 34% recently to less than $1,000/ FEU, an FBX record low for this lane. In spite of considerable blanked cruisings and sluggish steaming, usage levels are bad, pressing rates listed below agreement levels, break even levels, and the $1,300/ FEU mark that providers had the ability to sustain from April through July. Providers will blank much more capability– about 20% revealed up until now– in October to attempt and press rates back up even as volumes most likely decrease on this lane too.

In spite of transatlantic rates that are more than 40% lower than in 2019, and volumes also listed below 2019 levels (though they enhanced in July and August), this lane’s high share of capability released through vessel-sharing contracts or by alliances is making complex provider efforts to eliminate excess capability and push rates up.

In air freight, more forwarders are reporting indications of life for ex-Asia volumes, which is a promise for hopes of an air peak this year. Freightos Air Index information reveal Asia– N. Europe rates of $3.70/ kg have actually increased 27% given that completion of August, and transpacific rates of $4.41/ kg have actually climbed up 10%.

Freight news takes a trip faster than freight

Get industry-leading insights in your inbox.