Gabrijelagal/E+ through Getty Images

Intro

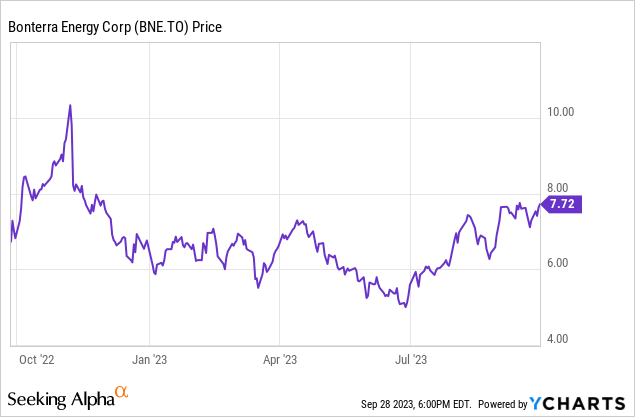

I have actually been watching on Bonterra Energy ( TSX: BNE: CA) ( OTCPK: BNEFF) for a long time now, as this business offers an exceptional torque on the oil cost. As the Canadian business still had to deal with fixing its balance sheet, the share cost stayed quite flat in the very first half of the year, however the current strong oil cost implies the stock is presently trading about 40% greater than the mid-C$ 5 level it was trading at when my previous post was released

A take a look at the Q2 results, and theorizing those to Q3

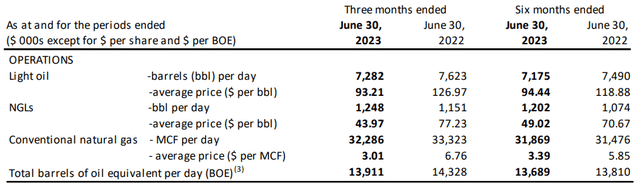

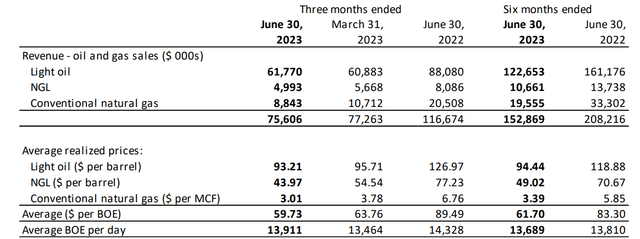

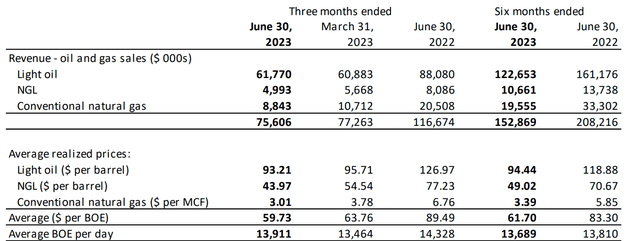

In the 2nd quarter of the year, Bonterra produced an overall of simply under 14,000 barrels of oil-equivalent each day and simply over 50% of the oil-equivalent production included light oil. NGLs represented about 9% while the gas production represented roughly 40% of the oil-equivalent production rate.

The oil was cost simply over C$ 93 per barrel, while the NGLs brought a cost of C$ 44 per barrel. It wasn’t a surprise to see the average recognized gas cost been available in significantly lower than in the very first quarter of this year and the 2nd quarter of in 2015. The typical recognized gas cost in the 2nd quarter was simply C$ 3.01. And due to that low gas cost, the overall contribution to the profits from gas sales was simply under 12% regardless of representing about 40% of the output.

This implies that while the gas cost might supply a good booster, Bonterra must still mainly be viewed as an oil manufacturer, as this represents about 75% of the overall profits.

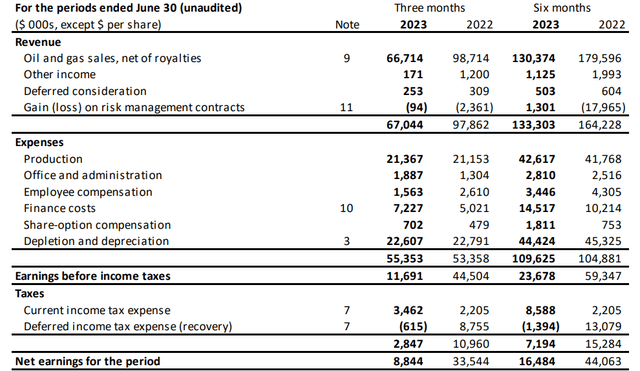

That overall profits was available in at C$ 67M web of royalties, and as the overall production expenses were still simply around C$ 21.4 M (for approximately simply C$ 17 per boe), the business published a pre-tax earnings of C$ 11.7 M, consisting of a C$ 22.6 M devaluation and deficiency cost.

This certainly suggested the business’s bottom line likewise plainly revealed Bonterra Energy paid. The overall net revenue was C$ 8.8 M, or C$ 0.24 per share. An excellent outcome and, as expected, the favorable totally free capital result assisted to more enhance the balance sheet.

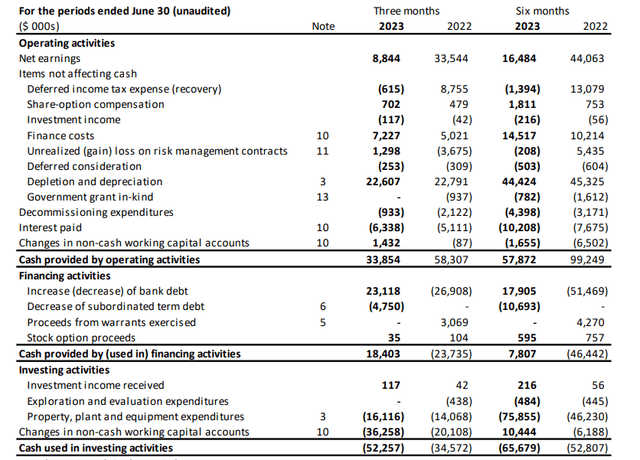

In the 2nd quarter of the year, Bonterra reported an overall operating capital of C$ 33.9 M and as you can see below, the overall capex was simply C$ 16M. This implies the hidden capital was roughly C$ 17.8 M and roughly C$ 16.4 M omitting the working capital modifications.

Remember, the 2nd quarter was extremely capex-light. As you can see in the image above, the overall capex was simply a portion of the C$ 59M invested in the very first quarter. Bonterra has actually validated it anticipates a full-year capex of C$ 120-125M, which implies the typical quarterly capex will likely be around C$ 30M. This implies the business’s underlying totally free capital would be simply a couple of million dollars.

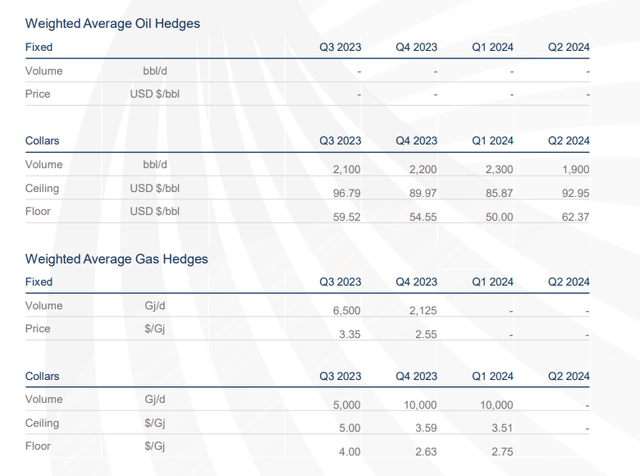

Nevertheless, the oil cost is now trading significantly greater than in the 2nd quarter of this year, which’s why I believed Bonterra offered an exceptional torque on the oil cost. As discussed above, the typical gotten oil cost was roughly C$ 93 per barrel in the 2nd quarter. With the WTI oil cost at around US$ 91/barrel today, the comparable cost in Canadian Dollar is roughly C$ 120. The typical cost was C$ 99/barrel in July and C$ 106/barrel in August. This implies it is not unimaginable to see a typical oil cost of C$ 107-110 per barrel throughout this quarter. That has to do with C$ 15/barrel greater than in the 2nd quarter of the year and even after subtracting the appropriate royalties, we can likely anticipate the operating capital to be about C$ 5-6M greater on a quarterly basis thanks to the greater oil cost. There are some hedges in location (see listed below), however the ceilings are high enough to gain from the existing strong oil cost.

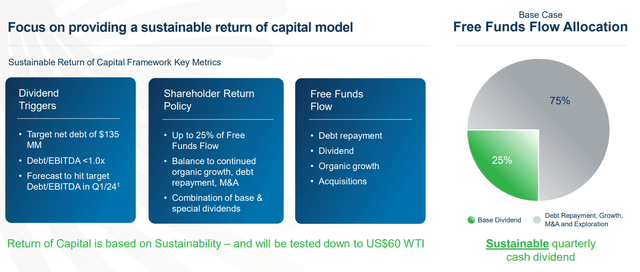

Although the business hasn’t satisfied its financial obligation targets yet, the business revealed a rebranding and a restored concentrate on investor benefits. When the net financial obligation level reduces to C$ 135M (a level which it expects to reach in the very first quarter of 2024), about 25% of the totally free funds circulation will be utilized to pay dividends.

This implies that at the existing oil cost and a somewhat greater production rate in 2024, the business might be on its method to a C$ 13-15M dividend payment, which would exercise to a C$ 0.35-0.40 dividend per share.

Financial investment thesis

I presently have a little long position in Bonterra Energy to gain from the greater oil cost. However as this is a little position, I am not exactly sure what I will finish with it. While the stock is still beautifully priced (and hence a ‘purchase’ status is still called for), I do not like my portfolio to be too fragmented and in the next couple of weeks or months I will need to decide whether I need to offer this position and purchase into another oil business, or if I require to more boost my position in Bonterra.

Editor’s Note: This post goes over several securities that do not trade on a significant U.S. exchange. Please know the dangers connected with these stocks.