ImagineGolf/iStock by means of Getty Images

Intro

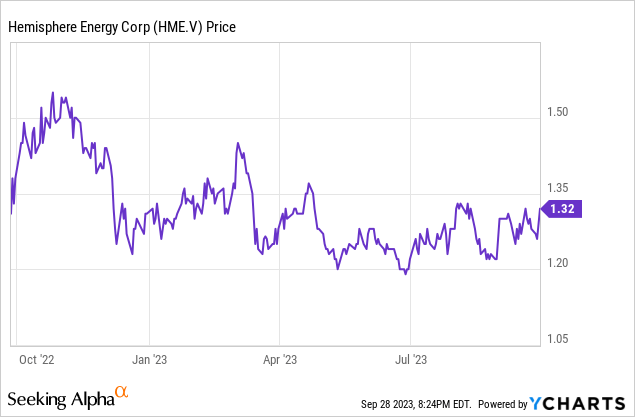

Back in July, I argued Hemisphere Energy ( TSXV: HME: CA) ( OTCQX: HMENF) was a fascinating dividend prospect thanks to its strong dividend policy The business is paying a quarterly dividend of C$ 0.025 per share which represented an 8% dividend yield, however Hemisphere’s dividend policy bases the dividends on the operating capital. As the oil rate was increasing (and consequently continued to increase throughout the 3rd quarter) I argued the dividend would likely be increased. This has actually now occurred. And although the Q3 results undoubtedly still need to be reported, Hemisphere has actually simply revealed a C$ 0.03 unique dividend, bringing the awaited dividend for the year is C$ 0.13 for a yield of in excess of 10%. I wished to have another appearance at the stock to determine how strong the 3rd quarter will be.

The Q2 results permit us to run the numbers on Q3

Prior to diving into my expectations for the 3rd quarter, it is very important to have a more detailed take a look at the Q2 results as that will be the beginning point for my Q3 forecasts.

As Hemisphere Energy generally produces heavy oil ( representing in excess of 99% of the overall oil-equivalent production), the WCS rate and the differential in between light oil and heavy oil is really essential for the business (and its investors).

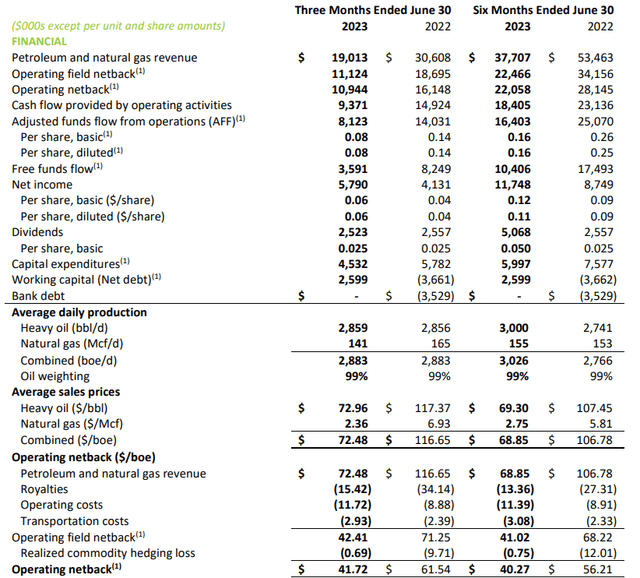

Throughout the 2nd quarter of the present fiscal year, Hemisphere reported a typical recognized rate of C$ 73 for its heavy oil and about C$ 2.36 for the really percentage of gas that was produced throughout the quarter. This led to a typical gotten rate of C$ 72.48 per barrel of oil-equivalent and this indicated the overall netback was C$ 42.41 per barrel of oil-equivalent, omitting hedge losses. The greatest operating expense wasn’t the pure production expense or the transport cost, however the royalties. As you can see below, the royalties comprised about 50% of all production expenses.

Hemisphere Financier Relations

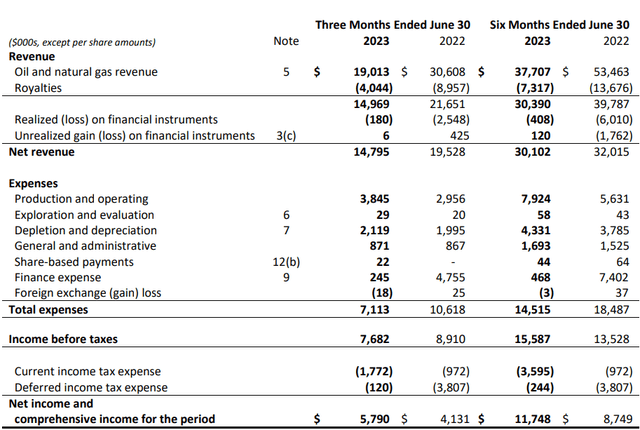

The overall income reported by Hemisphere in the 2nd quarter was roughly C$ 19M and about C$ 15M after taking the royalty payments into factor to consider. The overall net income of C$ 14.8 M likewise consisted of about C$ 0.2 M in hedging losses.

Hemisphere Financier Relations

And the earnings declaration undoubtedly likewise offers proof of the low expense nature of the production. The overall production expenses were less than C$ 4M and exhaustion and devaluation expenditures comprised about 30% of all operating costs. That’s excellent as this indicated the pre-tax earnings was available in at C$ 7.7 M representing a net revenue of C$ 5.8 M after covering a C$ 1.9 M tax costs. This indicates the EPS in the 2nd quarter was approximately C$ 0.06 and this undoubtedly likewise indicates the quarterly dividend of C$ 0.025 per share is extremely well covered as the payment ratio is less than 50%. Which was based upon a typical recognized rate of simply C$ 73 per barrel for the heavy oil.

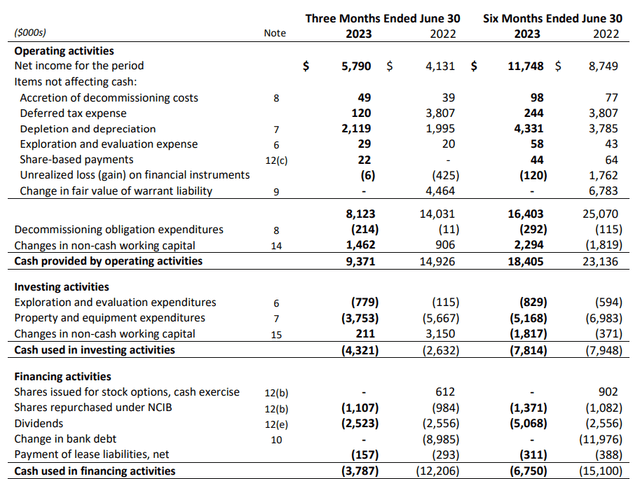

This wasn’t simply an accounting revenue as the business’s capital declaration appears to support the strong net revenue.

The image listed below programs the business created about C$ 9.4 M in running capital, however after subtracting the C$ 1.5 M contribution from working capital modifications and the C$ 0.2 M in lease payments, the adjusted operating capital was C$ 7.7 M. The overall capex and capitalized expedition money outflow was C$ 4.5 M, leading to a net totally free capital of C$ 3.2 M or C$ 0.032 per share.

Hemisphere Financier Relations

While this still completely covered the quarterly dividend, the totally free capital outcome was significantly lower than the earnings. This was mainly brought on by the high capex and capitalized expedition which was available in at more than two times the devaluation expenditures. This likewise was greater than the stabilized capex as Hemisphere is still assisting for a full-year capex of C$ 14M, representing C$ 3.5 M per quarter. And even if you would utilize C$ 4M per quarter, the totally free capital outcome would undoubtedly still be strong.

Now we have actually developed how strong the outcomes remained in the 2nd quarter, let’s take a look at what we might anticipate from the 3rd quarter.

Oil costs continued to increase and it is very important to keep in mind the heavy oil rate is increasing too. The WCS rate was C$ 83 in July, C$ 87 in August and will likely surpass C$ 95 for September. This indicates we can anticipate the typical recognized rate for the quarter to surpass C$ 85 per barrel and it might even be available in closer to C$ 90/barrel.

Presuming C$ 88/barrel as typical recognized rate for the quarter, Hemisphere’s income per barrel will increased by roughly C$ 14 compared to the 2nd quarter. And after subtracting the royalties and tax payments, the net operating capital need to increase by approximately C$ 7/barrel. At a production rate of 3,000 boe/day, this represents an extra net totally free capital of C$ 21,000/ day or C$ 1.8 M for the quarter.

An unique dividend is underway

Which indicates the Q3 totally free capital outcome might extremely well can be found in at C$ 5.5 M in the 3rd quarter (utilizing a stabilized capex of C$ 4M) which would represent about C$ 0.055 per share.

The business’s dividend policy requires a payment ratio of 30% of the changed funds circulation. At a typical heavy oil rate of C$ 88/barrel, the annualized changed funds circulation would be roughly C$ 38M which indicates the yearly dividend must be approximately C$ 0.12 per share. This goes through quality modification aspect per barrel of oil.

That likewise was what I was anticipating in the previous short article. However previously today, Hemisphere Energy revealed it will pay a unique dividend of C$ 0.03 per share in November. Integrated with the regular quarterly dividends of C$ 0.025 per quarter, the full-year dividend will be available in at C$ 0.13.

Financial investment thesis

And this reconfirms Hemisphere’s status as a small-cap oil business with dividend capacity. Since completion of June, the business had no gross financial obligation and a net money position of roughly C$ 4M, so it makes good sense the business continues to concentrate on keeping its investors pleased. I’m anticipating seeing the Q3 results and I would not be amazed to see an adjusted operating capital of C$ 10M and a stabilized totally free capital outcome of C$ 6M. For the time being, I’m a little more conservative and I will utilize an awaited totally free capital of C$ 5.5 M based upon a typical WCS rate of around C$ 88/barrel. However remember the present WCS oil rate is now more than 10% greater at approximately C$ 100/barrel.

I have a long position in Hemisphere, and although I’m generally concentrating on capital gains, I’m really pleased with the generous dividend payments.

Editor’s Note: This short article talks about several securities that do not trade on a significant U.S. exchange. Please know the threats related to these stocks.