Tl; dr: Powell “rotated”.

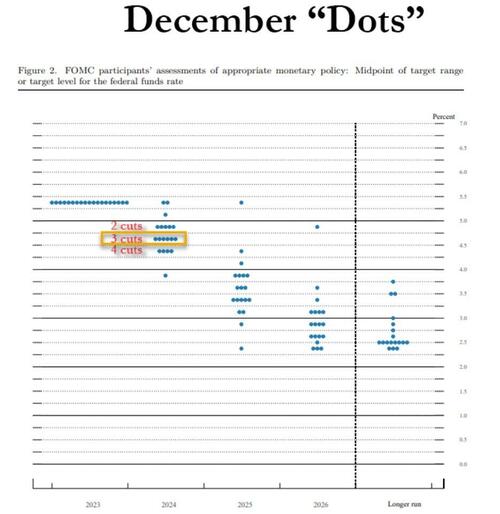

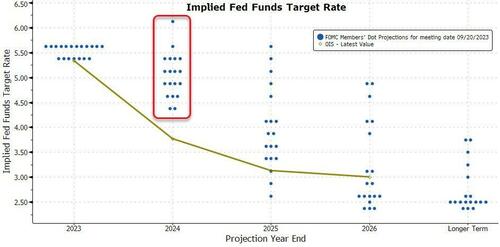

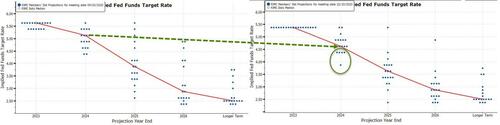

Rather of the old mantra of “do not combat The Fed”, it appears The Fed’s brand-new mantra is “do not combat the marketplace” as the Dot Plot changed down substantially more dovishly than anticipated, narrowing the space to the marketplace’s expectation substantially …

Mean evaluation of proper rate of policy:

-

2023 5.375% (variety 5.375% to 5.375%); prior 5.625%

-

2024 4.625% (variety 3.875% to 5.375%); prior 5.125%

-

2025 3.625% (variety 2.375% to 5.375%); prior 3.875%

-

2026 2.875% (variety 2.375% to 4.875%); prior 2.875%

Here’s what’s odd:

-

In Sept, Fed saw 2 cuts in 2024, 5 cuts in 2025

-

Now, Fed sees 3 cuts in 2024, 4 cuts in 2025

Put another method:

-

In Sept, 5 Fed members anticipated 3 cuts or more

-

In Dec, 11 Fed members anticipate 3 cuts or more.

So, is The Fed frontloading (in an election year) at the cost of 2025?

Will Powell let loose the hawknado?

* * *

Given that The Fed’s last conference (on Nov 1st), the marketplaces have actually been severe to state the least. The dollar (and gold) are lower as Bitcoin has actually skyrocketed greater and stocks and bonds both rose …

Source: Bloomberg

For context, that 9%- plus rally in the S&P 500 is the finest inter-meeting efficiency because June-August 2009

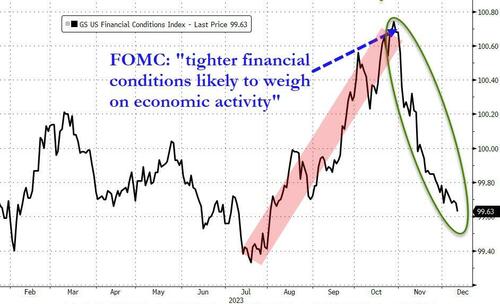

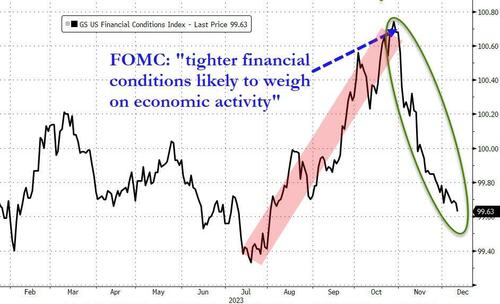

A lot more severe is the reality that the rally in bonds and stocks and decrease in the dollar has actually stimulated an practically extraordinary easing of monetary conditions because Nov 1st

Source: Bloomberg

This is especially notable since The Fed clearly pointed out the reality that “Tighter monetary … conditions … are most likely to weigh on financial activity, working with, and inflation” with the ‘the marketplace is doing The Fed’s task for it’ narrative being upheld by all.

Well, all that great by The Fed has actually now been reversed!

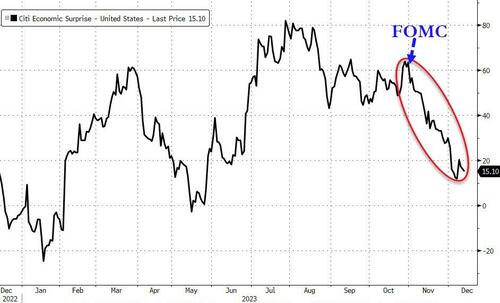

And with its typical lag, the previous tightening up appears to have certainly weighed down macro information …

Source: Bloomberg

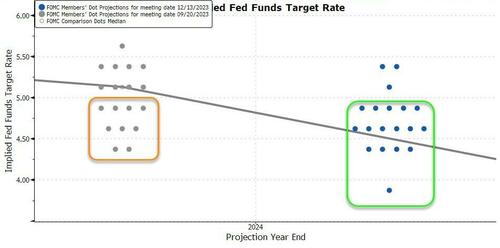

The marketplace has pressed considerably more dovish, prices in 125bps of rate-cuts next year (from around 75bps at the last Fed conference) …

Source: Bloomberg

And, as we have been highlighting, this suggests the marketplace is now pricing in an expectation that each and every single member of The Fed is incorrect (too hawkish) about rates next year …

Source: Bloomberg

Which leads us to the core these days’s FOMC declaration and interview, which is – simply just how much will they (hawkishly) press back versus the easing of monetary conditions or (dovishly) change their dots to satisfy the marketplace’s need?

As Mohamed El-Erian kept in mind simply ahead of the declaration:

Interesting to see markets press yields even more down ahead of this afternoon’s announcement/remarks.

Either they are comfy that there will be a January 2019 repeat or are candidly overlooking the longstanding mantra of “do not combat the Fed”.

Therefore, what did we get?

No modification in policy rates as totally anticipated – the 3rd successive conference in this “short-lived time out.”

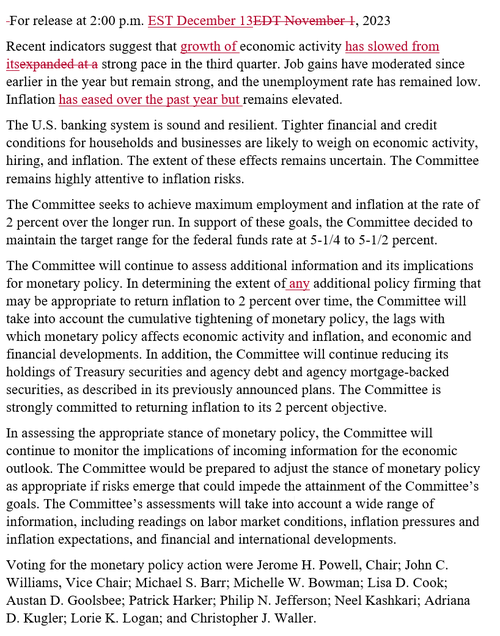

However, then released the doves in the declaration:

-

FOMC softens position towards more walkings by including one word to the declaration, stating authorities will think about the level of “any” extra policy firming that’s required

-

Fed likewise acknowledges that “inflation has actually alleviated over the previous year however stays raised,” and states that financial development has actually slowed from the 3rd quarter’s “strong rate”

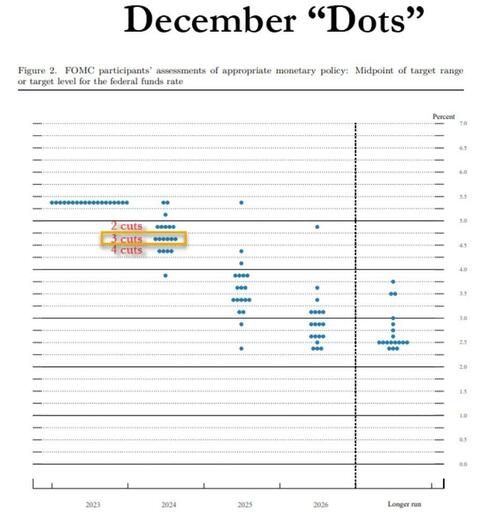

The dots went uber-dovish, with the mean dots requiring 3 cuts, up from 2 cuts before.

There are 5 Fed authorities listed below that media point (seeing 100bps of cuts) …

Mean evaluation of proper rate of policy:

-

2023 5.375% (variety 5.375% to 5.375%); prior 5.625%

-

2024 4.625% (variety 3.875% to 5.375%); prior 5.125%

-

2025 3.625% (variety 2.375% to 5.375%); prior 3.875%

-

2026 2.875% (variety 2.375% to 4.875%); prior 2.875%

In Addition, mean forecasts for inflation tick down in 2024 and 2025, while joblessness projections are little bit altered, suggesting Fed authorities’ growing self-confidence they can cool rate gains without huge task losses.

Before we leave for the presser, we did observe that The Fed left the list below sentence in the declaration:

” Tighter monetary and credit conditions for families and services are most likely to weigh on financial activity, working with, and inflation.”

The issue is – monetary conditions have ENORMOUSLY RELIEVED …

Is Powell simply getting lazy?

And now we await Powell’s presser, which UBS wittily referred to as follows:

” The conference will be followed by Fed Chair Powell providing the complete advantage of his financial insight at journalism rundown (this must not take long).

Powell will attempt to avoid markets from anticipating earlier rate decreases.

This job would be a lot simpler had Powell not trashed the Fed’s credibility for forward assistance“

Severe however reasonable.

* * *

Check out the complete redline listed below:

Packing …