Jean-Luc Ichard/iStock Editorial by means of Getty Images

Financial Investment Thesis

Today, I will provide you with 2 high dividend yield business that, for a variety of factors, may be appealing financial investment options for your financial investment portfolio.

Both Allianz SE ( OTCPK: ALIZY)( OTCPK: ALIZF) and Altria Group, Inc. ( MO) not just display considerable competitive benefits, however they likewise hold a strong position within their particular markets and currently have an appealing Appraisal. In addition to that, both business combine dividend earnings with dividend development.

Altria and Allianz’s appealing Dividend Yield [FWD] of 9.48% and 4.82%, in addition to their 5 Year Dividend Development Rate [CAGR] of 5.85% and 5.72%, suggest that they might be exceptional choices for those financiers looking for to integrate dividend earnings with dividend development.

Their appealing Appraisal is highlighted by various monetary metrics and attributes: Allianz’s P/E [TTM] Ratio currently stands at 12.03, which is just somewhat above the Sector Mean (10.18 ), to which it ought to be ranked with a premium due to holding an exceptional position within the Multi-Line Insurance coverage Market in mix with its strong competitive benefits. These attributes highlight that Allianz currently has a reasonable Appraisal. Altria’s present Appraisal (P/E [FWD] Ratio of 9.04) is substantially listed below the Sector Mean (P/E [FWD] Ratio of 19.04), suggesting that the business is currently underestimated.

Before I present the picked business to you in higher information, I wish to restate the basic advantages of purchasing high dividend yield business.

General Advantages of Buying High Dividend Yield Business

- The Generation of Earnings: Dividend paying business bring you the huge advantage of assisting you to produce earnings. This supplies you with much greater monetary versatility and uses the huge advantage of not needing to offer a few of your stocks when you may require some money at a time when the marketplace is not in your favor.

- Substantial Decrease of the Volatility and Threat Level of Your General Financial Investment Portfolio: Business that pay a reasonably high and especially sustainable dividend, tend to come connected to a lower danger level, especially when compared to development business, hence adding to lowering the volatility and general danger level of your financial investment portfolio (their lower danger level can be shown in their lower Beta Aspect).

- Mental Financier Advantages in Times of a Stock Exchange Decrease: In times of high volatility and decreasing stock exchange, getting dividend payments can bring you a mental result that can lead you to keep the positions in your portfolio to continue gaining from dividend payments, imitating an entrepreneur, rather of a stock exchange trader. This habits can assist you to substantially increase your wealth over the long term.

Allianz

Established in 1890, Allianz is a multi-line insurer based in Germany. The business displays an Aa2 credit ranking from Moody’s, which highlights its huge monetary health and appearance for long-lasting financiers.

Amongst Allianz’s competitive benefits are its monetary health (EBIT Margin [TTM] of 9.78% and Return on Typical Equity of 15.20%), strong brand name image, broad item portfolio (it supplies property-casualty insurance coverage, life/health insurance coverage, and possession management services and products around the world), and its strong proficiency in danger management.

Allianz’s Existing Appraisal

In regards to Appraisal, it can be highlighted that Allianz presently has a P/E GAAP [TTM] Ratio of 12.03, which stands somewhat above the Sector Mean of 10.18.

Nevertheless, due to the business’s considerable competitive benefits in mix with its monetary health, I think that Allianz ought to be ranked with a premium in contrast to its rivals. For that reason, I think that Allianz is currently a minimum of relatively valued.

This viewpoint is additional highlighted by the business’s Dividend Yield [TTM] of 4.82%, which remains in line with its average from the previous 5 years (which is 4.90%).

Allianz’s Dividend and its Mix of Dividend Earnings and Dividend Development

Currently, Allianz pays a Dividend Yield [FWD] of 4.82%. At the business’s present cost level, it boasts a Totally free Capital Yield [TTM] of 3.79%, highlighting its enticing risk/reward profile.

In addition, it can be highlighted that Allianz has actually revealed a Dividend Development Rate [CAGR] of 5.72% over the previous 5 years, suggesting that the business is an enticing financial investment choice for those financiers that intend to integrate dividend earnings with dividend development.

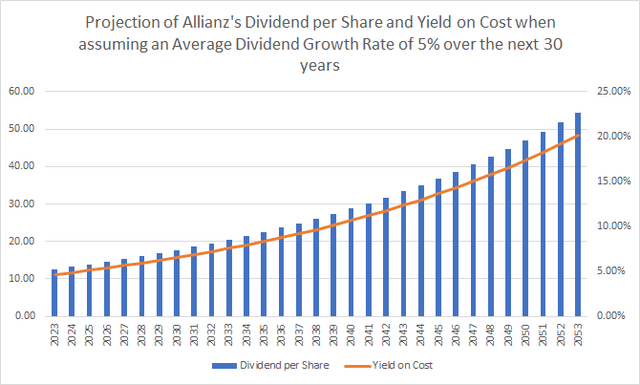

The Forecast of Allianz’s Dividend and its Yield on Expense

The graphic listed below shows the forecast of Allianz’s Dividend and Yield on Expense when presuming a Typical Dividend Development Rate of 5% for the following thirty years (which remains in line with the business’s 5 Year Dividend Development Rate [CAGR] of 5.72%).

The chart listed below programs that you might reach a Yield on Expense of 7.58% by 2033, 12.35% by 2043, and 20.12% by 2053, even more highlighting my theory that the business is an appealing option for financiers looking for to integrate dividend earnings with dividend development.

Altria

Altria produces, and offers smokeable and oral tobacco items in the United States. Amongst the business’s competitive benefits are its strong Success (EBITDA Margin [TTM] of 60.92% and A3 credit ranking from Moody’s), its economies of scale, broad circulation network and prices power, in addition to its broad item portfolio of strong brand names (Marlboro, the business’s leading brand name, is currently noted as the 44th most important brand name on the planet, according to Brand Name Financing).

Altria’s Existing Dividend

At this minute in time, Altria pays a Dividend Yield [FWD] of 9.48%, which can substantially boost earnings generation. This Dividend Yield ends up being a lot more appealing to financiers when thinking about the business’s 5-year Dividend Development Rate [CAGR] of 5.85% in mix with its modest Payment Ratio of 76.77%. It is additional worth highlighting that Altria displays a 5-Year Typical EPS Watered Down Development Rate [FWD] of 5.75%.

Jointly, these monetary metrics suggest that the business’s dividend is reasonably safe, though not ensured.

Altria’s Existing Appraisal

As things stand, Altria has a P/E [FWD] Ratio of 9.01, which stands 52.69% listed below the Sector Mean of 19.04, and 26.47% listed below its average over the previous 5 years (12.25 ). Both metrics recommend that Altria is currently underestimated.

The business’s undervaluation is additional evidenced by its Price/Sales [FWD] Ratio of 3.56, which stands 13.16% listed below its average from the previous 5 years.

Altria’s undervaluation is additional evidenced by a Dividend Yield [TTM] of 9.19%, standing somewhat above its typical Dividend Yield [TTM] from the previous 5 years (which is 7.58%).

Altria’s present Appraisal and appealing Dividend Yield [FWD] of 9.48% have actually played a substantial function in me choosing it as one of my 2 leading dividend yield business to think about purchasing this month.

Altria’s Success

Altria is an exceptional option in regards to Success, which is evidenced by its EBITDA Margin [TTM] of 60.92%, standing substantially above the Sector Mean of 11.26%. Additionally, the business’s Earnings Margin [TTM] of 42.60% lies well above the Sector Mean of 4.90%, additional highlighting its exceptional Success metrics.

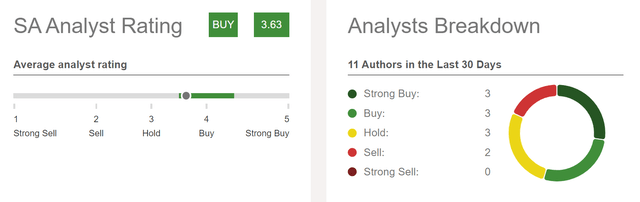

Altria According to the Looking For Alpha Experts and the Wall Street

Listed below you can discover the outcomes of the Looking for Alpha Expert Ranking. According to this ranking, Altria is currently ranked as a buy. The business got a strong buy ranking from 3 experts, a buy ranking from 3 experts, and a hold ranking from 3 experts.

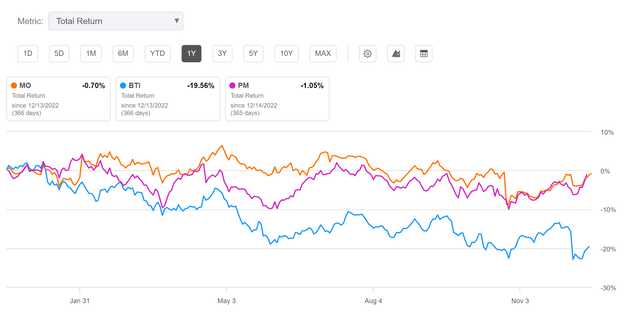

Altria Compared to Its Rivals

When comparing Altria to rivals such as British American Tobacco p.l.c. ( BTI) and Philip Morris International Inc. ( PM), it can be mentioned that Altria has actually revealed greater dividend development rates and a greater Success.

While Altria’s 5 Year Dividend Development Rate [CAGR] and its EBIT Margin [TTM] stand at 5.85% and 59.67%, the exact same are 2.45% and 48.10% for British American Tobacco, and 2.94% and 35.34% for Philip Morris.

Nevertheless, it can be highlighted that British American Tobacco currently has the most affordable Appraisal amongst the 3 business: while British American Tobacco presently displays a P/E [FWD] Ratio of 7.21, Altria’s is 9.01, and Philip Morris’ is 18.67.

The graphic listed below shows the previous 12-month efficiency of these 3 rivals, highlighting that British American Tobacco has actually revealed the weakest efficiency (-19.56%) when compared to Altria (-0.70%) and Philip Morris (-1.05%). This has actually substantially added to British American Tobacco’s present low Appraisal.

Threat Analysis

Carrying out a detailed danger analysis is vital for financiers to restrict the disadvantage danger of their financial investment portfolio and consequently increase the possibility of beneficial financial investment outcomes.

Threat Analysis – Allianz

Secret Threat Elements for Allianz Investors to Think About

- Market Threat: Market Threat can be associated to rate of interest danger, inflation danger, equity danger, credit spread danger, currency danger and realty danger. All of which can have considerable unfavorable influence on the monetary outcomes of Allianz, representing danger elements for you as a financier.

- Credit Threat: Allianz’s credit danger profile stems from several sources: their financial investment portfolio, their credit insurance coverage, and their external reinsurance. Credit danger mostly emerges when a counterparty is not able or reluctant to meet legal responsibilities.

- Functional Threat: Allianz’s functional danger especially describes losses in the insurance coverage or possession management company, which can have unfavorable results on the business’s company outcomes and represent extra danger elements for Allianz financiers.

Lowering Portfolio Threat When Buying Allianz for Improved Financial Investment Outcomes: The Case for a 5% Allotment Limitation and for a Long-Term Financial Investment Technique

To lower company-specific concentration danger and therewith the general danger level of your financial investment portfolio, I recommend investing a optimum of 5% of your general financial investment portfolio in Allianz.

I think that the danger elements pointed out above can certainly have a substantial effect on the business’s monetary outcomes, especially in the short-term.

For this factor, if you choose to buy Allianz, I recommend a long-lasting financial investment technique with a minimum holding duration of 7 years. This permits you to substantially take advantage of the gradually increasing dividend payments of the business while assisting you invest with a minimized danger level.

Threat Analysis – Altria

Secret Threat Elements for Altria Investors to Think About

- Minimal Development Viewpoint: Altria runs in a market that deals with decreases in cigarette smoking rates, suggesting minimal development viewpoints. Regardless of these obstacles, its strong client commitment places the business to offset this effect through item cost improvements.

- Regulative Dangers: The Tobacco Market deals with strict policy. Extra regulative steps might adversely impact Altria’s monetary efficiency, representing an extra danger aspect that financiers must think about.

- Tax Dangers: Tobacco items currently sustain considerable tax, and a possible boost in taxes on tobacco-related items might have a strong unfavorable result on the business’s monetary efficiency, representing an extra danger aspect for Altria financiers.

Lowering Portfolio Threat When Buying Altria for Improved Financial Investment Outcomes: The Case for a 5% Allotment Limitation for Altria and a 10% Allotment Limitation for Business from the Tobacco Market

To alleviate the disadvantage danger of your financial investment portfolio, I normally recommend restricting the Altria position to a optimum of 5% of your general financial investment portfolio.

In addition to that, I recommend restricting the direct exposure to business from the Tobacco Market to a optimum of 10% of your general portfolio. This method assists to reduce the threats associated with guidelines and taxes, in addition to lowering the industry-specific concentration danger.

Making The Most Of Financier Advantages when Buying Allianz and Altria

In case you choose to consist of Allianz and/or Altria in your financial investment portfolio, you might benefit most when including both business into a healthy and broadly varied financial investment portfolio that combines dividend earnings with dividend development.

Such a portfolio ought to consist of both high dividend yield business (such as Allianz and Altria), however likewise business that concentrate on dividend development.

Listed below you can discover a list of 10 high dividend yield business and a list of 10 dividend development business that I presently think about to be appealing to buy:

My Leading 10 High Dividend Yield Business For December 2023

With the building and execution of The Dividend Earnings Accelerator Portfolio, I am following a financial investment technique that combines dividend earnings with dividend development. This technique intends to lower danger levels for financiers, consequently improving the likelihood of attaining a beneficial Overall Return over the long term.

Why Allianz is a Prospect for Possible Addition into The Dividend Earnings Accelerator Portfolio

Due to Allianz’s considerable competitive benefits, its monetary health (Aa2 credit ranking from Moody’s), appealing Appraisal (P/E GAAP [TTM] Ratio of 12.03) and its mix of dividend earnings (Dividend Yield [FWD] of 4.82%) and dividend development (5 Year Dividend Development Rate [CAGR] of 5.72%), the business is absolutely an appealing prospect for possible addition into The Dividend Earnings Accelerator Portfolio.

Nevertheless, the Financials Sector currently represents a high percentage of The Dividend Earnings Accelerator Portfolio, presently representing 33.07% (when designating Schwab U.S. Dividend Equity ETF to the business it is purchased).

For this factor, I prepare to include Allianz to the portfolio once I have actually even more reduced the percentage of the Financials Sector on the general financial investment portfolio. This method is targeted at keeping a minimized sector-specific concentration danger while reducing the general danger level of the portfolio.

Why Altria is a Prospect for Possible Addition into The Dividend Earnings Accelerator Portfolio

Like Allianz, I see Altria as a strong prospect for possible addition into The Dividend Earnings Accelerator Portfolio. This is because of the business’s mix of dividend earnings (Dividend Yield [FWD] of 9.48%) and dividend development (5 Year Dividend Development Rate [CAGR] of 5.85%), its strong competitive benefits, and exceptional position within the Tobacco Market, in addition to its strong Success.

The primary reason I still have not consisted of Altria in The Dividend Earnings Accelerator Portfolio is due to the fact that of the portfolio’s financial investment in Schwab U.S. Dividend Equity ETF, through which the portfolio currently has a stake in the business.

I prepare to consist of the business after attaining a wider diversity, hence making sure that Altria will not end up being a disproportionally high share of the general portfolio.

Conclusion

I think about both Altria and Allianz to be appealing financial investment options. This is because of their strong competitive benefits, dominant position within their particular markets, their monetary health (A3 and Aa2 credit ranking from Moody’s), appealing Assessments and the reality that they offer financiers with a mix of dividend earnings and dividend development.

Altria presently uses financiers a Dividend Yield [FWD] of 9.48% and displays a 5 Year Dividend Development Rate [CAGR] of 5.85%. The exact same metrics are 4.82% and 5.72% for Allianz.

Nevertheless, due to the danger elements that come connected to a financial investment in both business, I recommend restricting the Altria and Allianz positions in relation to the general portfolio to an optimum of 5% each.

In addition, I recommend not investing more than 10% of your financial investment portfolio into the Tobacco Market, especially due to regulative danger elements and the minimal development point of view of this sector.

I think that you might benefit most when consisting of both Altria and Allianz in a financial investment portfolio that combines dividend earnings with dividend development. This is the approach behind The Dividend Earnings Accelerator Portfolio, which I am presently establishing, carrying out, and recording on Looking for Alpha.

I have strategies to consist of both Altria and Allianz in The Dividend Earnings Accelerator Portfolio when a wider portfolio diversity has actually been attained. This is to decrease both company-specific and sector-specific concentration threats, consequently increasing the capacity for favorable financial investment results for financiers who embrace the portfolio’s financial investment approach.

Author’s Note: Thank you for checking out! I would value hearing your ideas on this financial investment short article on Allianz and Altria. Which high dividend yield business are you think about ing investing in throughout this month of December?

Editor’s Note: This short article talks about several securities that do not trade on a significant U.S. exchange. Please understand the threats connected with these stocks.