NoSystem images/E+ by means of Getty Images

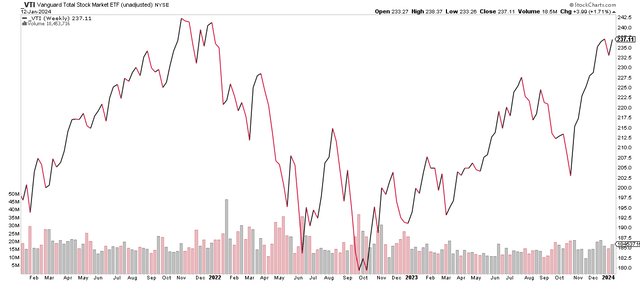

The S&P 500 is up 10 of the last 11 weeks. The Lead Overall Stock Exchange Index Fund ETF Shares ( NYSEARCA: VTI) can state the very same, though the ETF stopped working to settle at a fresh all-time weekly high close, whereas the SPX did. VTI’s substantial weight in domestic mid-cap stocks, with a splice of little caps, usually injured relative efficiency to the large-cap index over the previous three-plus years. United States SMID caps peaked in Q4 2021 and have actually backtracked just about half of their late 2021 to October 2022 bearish market.

I am reducing VTI from a buy to a hold based upon greater appraisals, combined momentum signals, and questionable seasonal patterns that frequently take place throughout the very first half of election years. For background, VTI looks for to track the efficiency of the CRSP United States Overall Market Index. The fund holds big-, mid-, and small-cap equities diversified throughout development and worth designs and uses a passively handled, index-sampling method, according to Lead

VTI: Up 10 of the last 11 Weeks

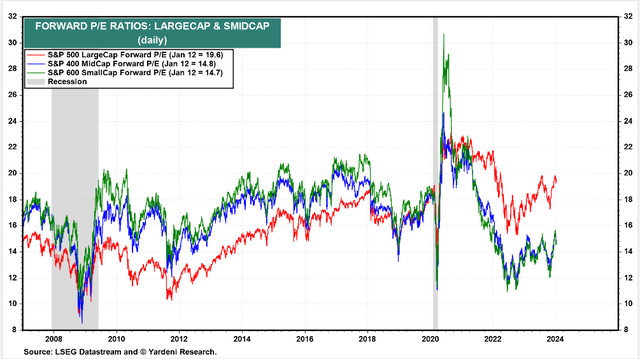

As it stands, VTI trades at a lofty forward non-GAAP price-to-earnings ratio near 19. That raised appraisal multiple is not severe, though. Think about that the high-growth and fairly protective Infotech sector consists of more than 27% of the allotment.

I.T. stocks naturally command a greater appraisal, so big caps’ 19.6 P/E, per Yardeni Research study, is sensible while about a 15 numerous on SMIDs might be reasonable based upon their lower quality and more cyclical nature. To put it simply, stocks are priced perhaps not to excellence, however they have definitely baked in a Goldilocks financial result.

United States Stock Exchange Valuations by Market Cap: P/Es off the Lows

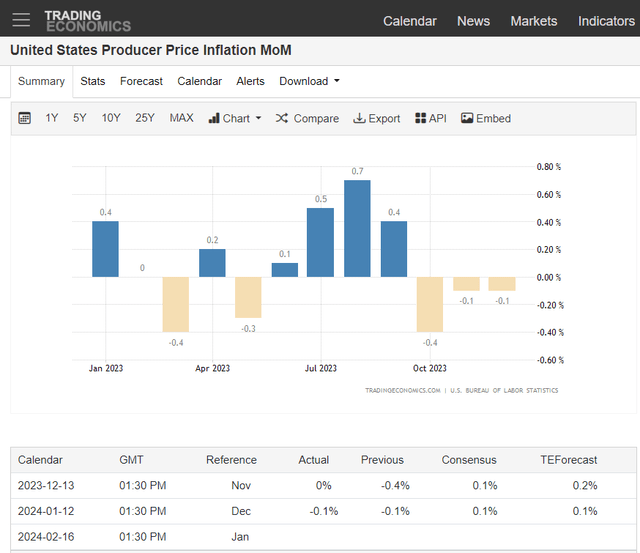

Think About that Core PCE is now under the Fed’s 2% target on a six-month annualized basis (Core PCE inflation is the Fed’s favored inflation gauge). Recently, while CPI numbers was available in on the warm side, PPI verified that wholesale rates continue to in fact deflate, dropping another 0.1 portion point in December.

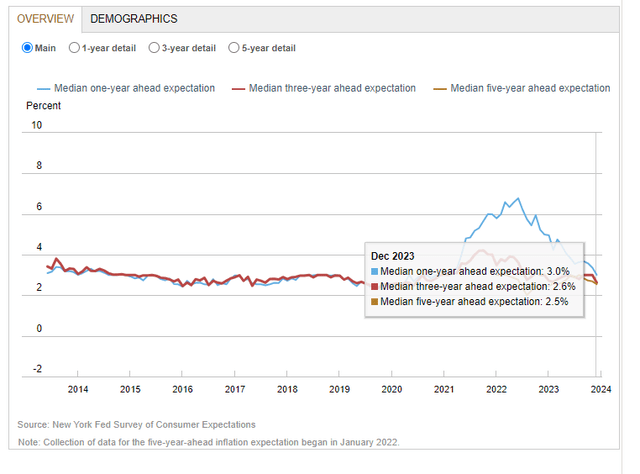

The inflation landscape was cast in a much better light early recently, too. The New York City Fed Study of Customer Expectations exposed that Americans are more sanguine about future inflation levels– short-term inflation expectations dropped to their most affordable level in 3 years.

United States PPI Decreases for a 3rd Straight Month

NY Fed Study: Reduced Customer Inflation Expectations

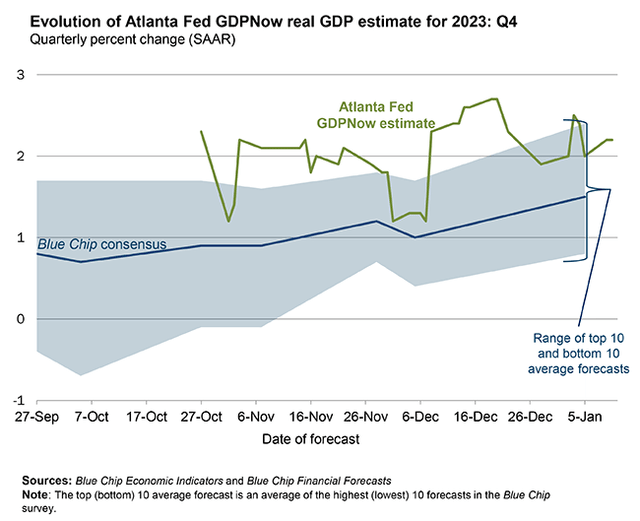

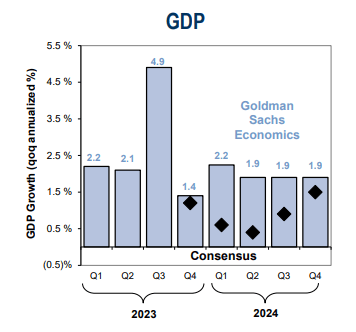

On the development side of the journal, the Atlanta Fed’s GDPNow tool reveals the United States economy humming along at a good 2.2% genuine rate for Q4. While that is below the outstanding growth rate seen in Q3 in 2015, there’s definitely little proof of a tough landing and even any stretch of unfavorable genuine GDP development in the offing.

Q4 United States Genuine GDP Development Seen at +2.2%

Financial experts presently anticipate the United States genuine GDP development rate to trough in Q1 and Q2 this year, avoiding a technical economic downturn, before a re-acceleration occurs in the 2nd half of 2024. Much will depend upon how the tasks scenario unfolds in addition to what retail sales appear like following a vacation shopping season that was excellent, not excellent. Likewise, the Q4 2023 business profits season will clarify the health of business huge and little.

Agreement United States Genuine GDP Projection

Goldman Sachs

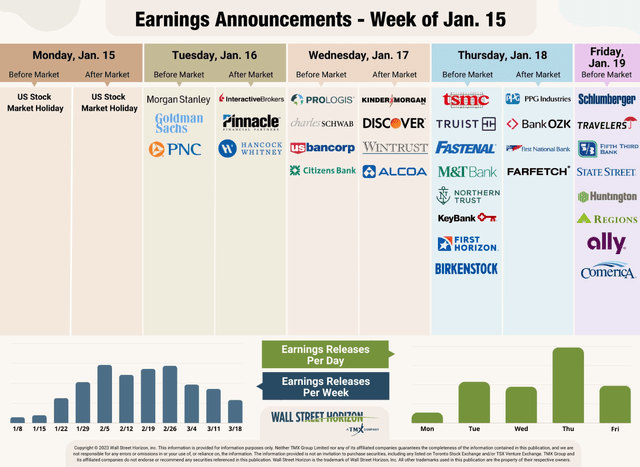

According to FactSet, for Q4 2023 (with 6% of S&P 500 business reporting real outcomes), 76% of S&P 500 business have actually reported a favorable EPS surprise and 55% of S&P 500 business have actually reported a favorable income surprise, however the combined (year-over-year) profits decrease for the S&P 500 is -0.1% after a rebound in EPS development reported in Q3. Still, strategists anticipate per-share earnings development to have actually continued last quarter, and we will understand a lot more in the next 3 weeks as the bulk of SPX profits struck the tape.

Incomes on Tap Today

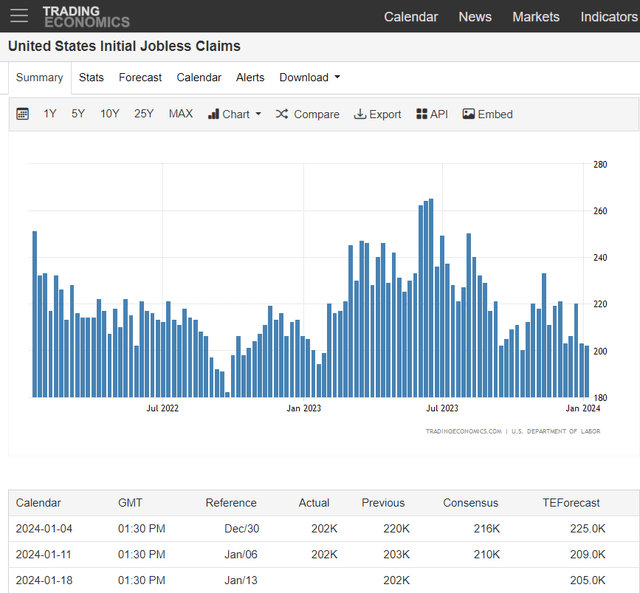

I pointed out the labor market previously. Work development has actually definitely receded over the last couple of quarters, however Preliminary Out of work Claims stay incredibly low by historic requirements, and regular monthly gains in the NFP facility payrolls report recommend hiring is still going on.

What’s more, wage development has actually steadied at a good 4% clip on a year-over-year basis. Unfavorable modifications to the heading tasks print and volatility in the family study, utilized to compute the joblessness rate, are things the bears indicate. Likewise worrying was a surprise downtick in the ISM Providers Work sub-index for the month of December.

Sanguine Jobless Claims Numbers

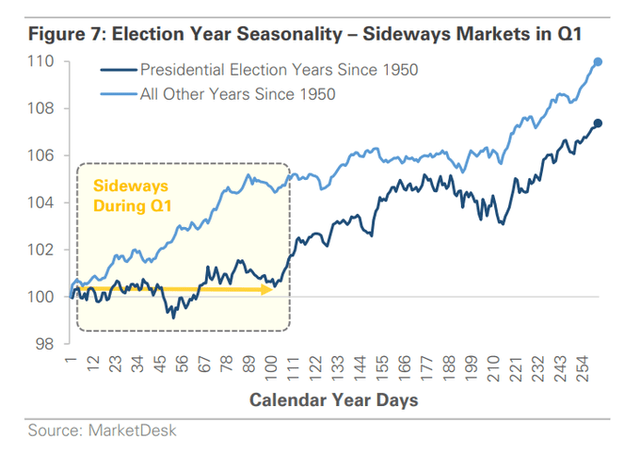

When It Comes To VTI and the broad United States stock exchange, I anticipate bouts of volatility occasionally throughout the very first half of 2024. With the Iowa Caucuses happening on Monday, a market vacation, we are now in the heart of main election season.

Betting markets recommend a high likelihood of a Trump versus Biden rematch remaining in the cards, so possibly equities will not be rattled rather as much as they otherwise would be by severe policy concepts as prospects look for to attract their particular bases. Nonetheless, stocks frequently stumble at the state of election years, according to information created by MarketDesk.

Choppy Cost Action into Q2 of Election Years

The Technical Take

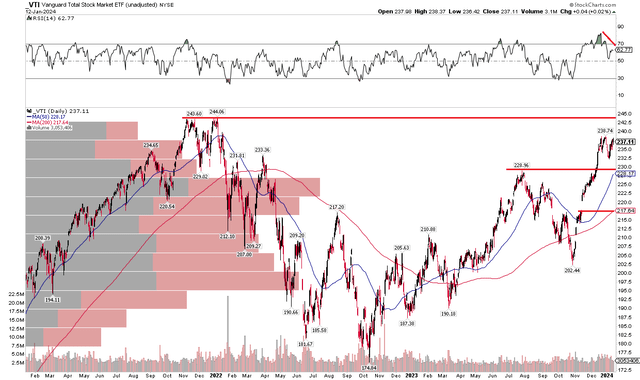

As we form a narrative about VTI for the next couple of months, let’s take a look at its momentum scenario. Notification in the chart listed below that the fund, unlike the S&P 500, has actually not looked above its early 2022 all-time high. If we see VTI increase above $245 on a weekly closing basis, perhaps we can get more useful, however I see the danger of a trading variety emerging on a near-term basis. Assistance is seen at the $229 mark– that was the high from July in 2015 and it is likewise where the increasing 50-day moving average enters play. I see next assistance even more down at $218– there’s a considerable cost space there in addition to the increasing 200-day moving typical offering technical confluence.

Likewise have a look at the RSI momentum gauge at the top of the chart– while not a technical bearish divergence, VTI’s RSI was at a much weaker level to close recently while the S&P 500 settled at a fresh all-time weekly high close. I wish to see a cost thrust verified by robust momentum, in addition to with increased volume. In the meantime, $244 seems resistance while $229 is near-term assistance.

VTI: Stays Listed Below the All-Time High, Assistance at the Summertime 2023 Peak

The Bottom Line

I am reducing VTI from a buy to a hold. I was bullish on the United States stock exchange heading into the last 2 months of the year provided seasonal tailwinds and severe bearishness in October. Now, however, momentum has actually subsided and a more unpredictable seasonal stretch is underway. VTI’s appraisal is not all that inexpensive, either, while macroeconomic conditions are blended as genuine GDP development slows.