Dilok Klaisataporn

The following is a summary of the marketplace cycle as it stands at the start of Q1 2024. We will concentrate on the core of the cycle– business incomes– and work our escape in order to get a detailed view of markets throughout possession classes. This will assist arrange our analysis over the coming quarter. Normally, nevertheless, a disinflationary downcycle stays undamaged. This agrees with for Treasuries, undesirable for products, and unsafe for equities.

Specifying Market Cycles

Initially, a quick word on how “the marketplace cycle” is specified here, which will assist establish the order in which the essential variables will be evaluated. Based upon historic analysis, oftentimes returning a century and a half, there are a variety of essential variables that relocate a cyclical style and tend to be associated with one another (although there are fairly routine leads and lags to those connections). Utilizing 16-month rates of modification (or more smoothed variations utilizing rates of modification relative to a 36-month moving typical or comparable, however more complex, analytical strategies) appear to expose details about future modifications of that offered variable in addition to other cyclical variables. This has actually been gone over in higher information in my short articles concentrated on particular products and Treasuries

Why offered variables are more associated with one another or why the 16-month rate of modification seems more significant than others are intriguing subjects however stay shrouded in secret. However, these relationships seem rather constant and rather predictive, so it is necessary to track them when eagerly anticipating the future, and for thinking of how markets in fact operate in contrast to what financial theory may state.

As pointed out above, business incomes for the marketplace as an entire seem the core variable. Following incomes in value is commercial metals rates, due to the fact that commercial metals cycles are regularly associated with incomes cycles, however there is a lag in the release of incomes information whereas products rates are actual time. So, analytically, commercial metals are as essential as business incomes in cycle analysis.

Beyond incomes and commercial metals rates are product rates normally, with some product classes being more associated with the core cycle than others. Rare-earth elements tend to lead the cycle; basic materials (like cotton) tend to move with the cycle; grains tend to a little lag; and energy (most especially petroleum) lags grains. Fertilizers tend to fall in between grains and energy. Other food and drink products are far more irregular (cocoa is an especially frustrating example), however over the long term, they tend not to roam too far from the overall market cycle.

Then, there are long-lasting rates of interest, which tend to lag. Short-term rates of interest are not as carefully connected to the marketplace cycle and appear to bridge the marketplace cycle and the “ organization cycle” (the growth and contraction of genuine GDP mostly). Customer inflation, especially services inflation, and GDP remain in a much larger orbit of the marketplace cycle. Likewise, stock rates appear to have an orbit that is affected by forces that are not mostly cyclical (this has actually been gone over thoroughly in other short articles, such as those here). In truth, when it concerns tracking stock cyclicality, it is best to utilize pattern analysis instead of momentum analysis.

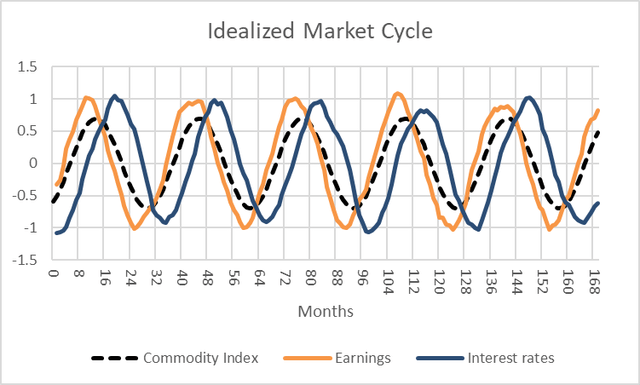

These basic, core relationships can be summed up in the following charts. The very first programs idealized oscillations in the rates of modification of products, S&P 500 tracking twelve-month incomes, and long-lasting rates of interest.

Chart A. Rates of modification in incomes, products, and rates of interest tend to move together. ( Author)

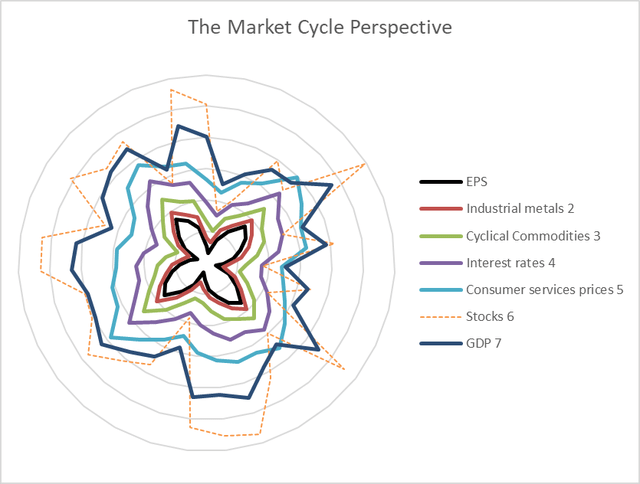

The 2nd chart reveals the idealized structure of the marketplace cycle, with incomes at the core and GDP and stock returns being the most peripheral.

Chart B. The core of the marketplace cycle is incomes and commercial metals. ( Author)

So, we are going to move from the core to the periphery, mostly utilizing log rates of modification relative to 36-month moving averages, other than for stocks.

Initially, incomes and products.

The Marketplace Cycle Core

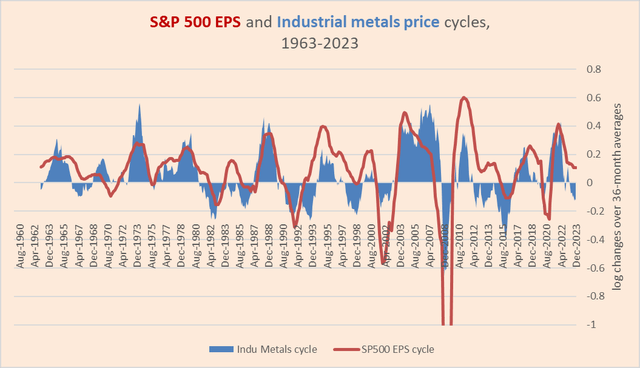

Industrial metals are plainly in a downcycle, as are business incomes, although at a much greater trough than the metals, which accounts, together with the high level of services inflation, for the stock exchange’s resiliency (as recommended by the Gibson Impact).

Chart C. Cycles in S&P 500 incomes and commercial metals rates tend to be associated with one another. ( World Bank; S&P Global; Robert Shiller; Author computations)

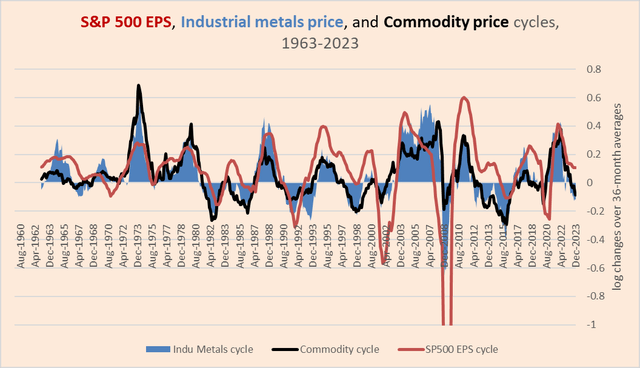

We can then take the very same chart and include the total product cycle.

Chart D. Product cycles total tend to be associated with the incomes cycle, too. ( World Bank; S&P Global; Robert Shiller; Author computations.)

This appears to verify a general drop.

We can then focus and broaden deep space of variables.

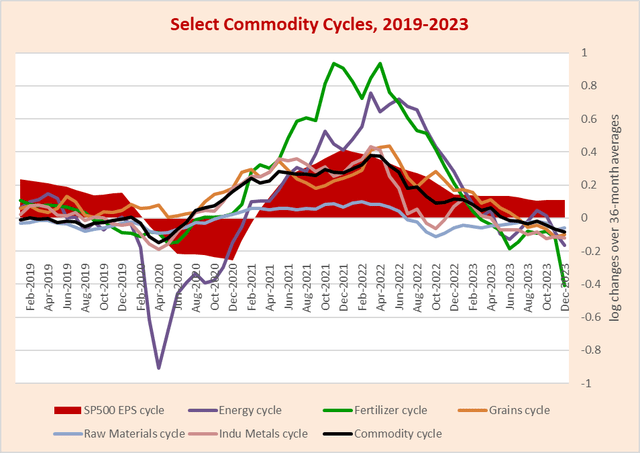

Chart E. All cyclical products have actually been decreasing over the last 2 years. ( World Bank; S&P Global; Robert Shiller; Author computations)

Although any single variable can be unstable, normally they are near-unanimous in their drop.

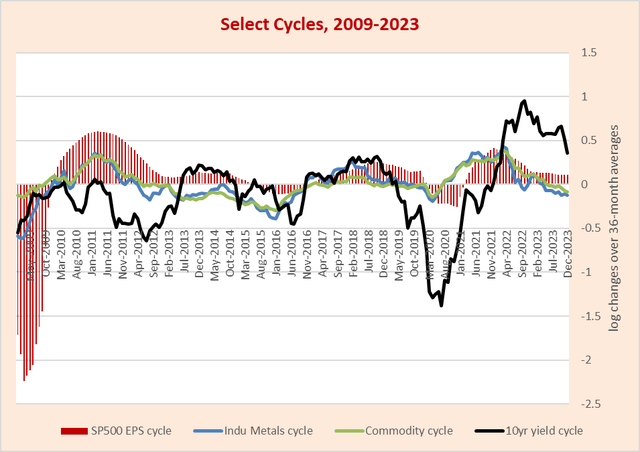

Let’s include the rate of interest cycle to the mix.

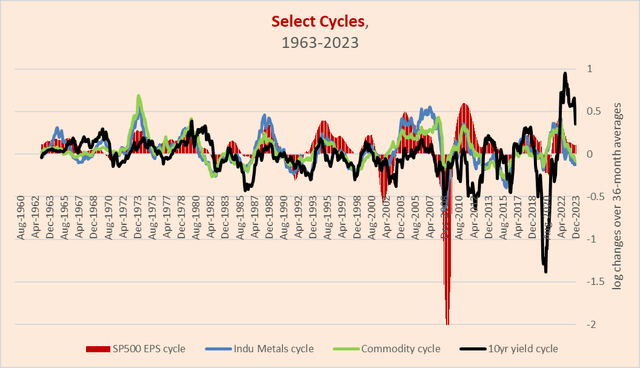

Chart F. The rate of interest cycle experienced its biggest divergence from the marketplace cycle because the early 1980s. ( World Bank; S&P Global; Robert Shiller; St Louis Fed; Author computations)

So, here we can see that the rate of interest cycle has actually diverged greatly from the marketplace cycle, possibly to the best degree because the early 1980s, when we last saw a disinflationary cycle integrated with rates of interest ‘greater for longer’.

It deserves keeping in mind that even rates of interest have actually diverged from the interest cycle, as the cycle (as specified here) has actually remained in basic decrease because late 2022 however rates of interest just peaked (presuming that was the peak) in late 2023.

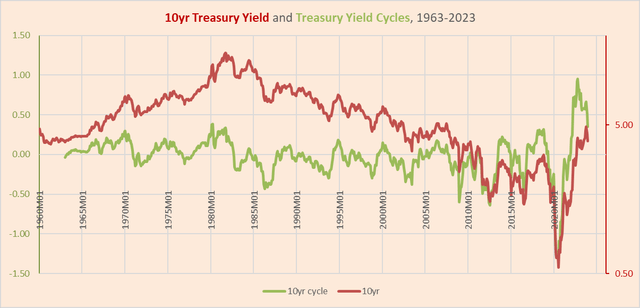

Chart G. The rate of interest cycle experienced its biggest divergence from rate of interest levels in the last 50 years. ( St Louis Fed; Author computations.)

Here is another zoomed-in view.

Chart H. The rate of interest cycle seems reconverging with the marketplace cycle. ( World Bank; S&P Global; St Louis Fed; Author computations)

Rate of interest are plainly connected to the core market cycle however are not slavishly loyal to it.

All in all, the marketplace cycle remains in a disinflationary drop, and this is feeding into more peripheral aspects like customer rates and GDP.

The Marketplace Cycle Periphery

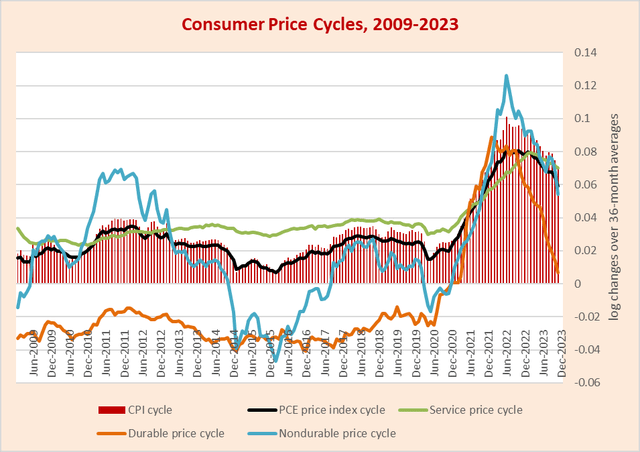

Below is a zoomed-in chart of customer cost variables.

Chart I. Customer inflation remains in constant decrease. ( St Louis Fed; Author computations)

Item inflation has actually fallen significantly because 2021, and services inflation peaked in late 2022.

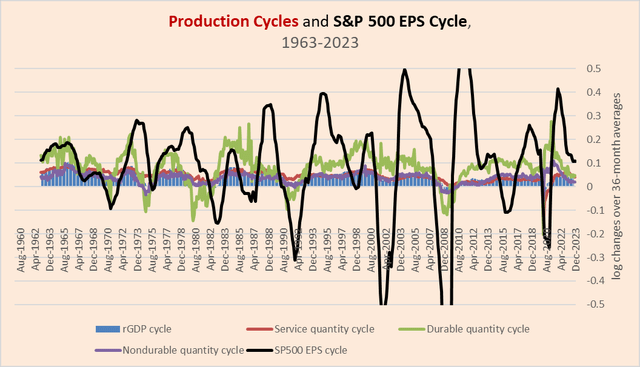

Production cycles are a lot more loosely linked to the incomes cycle, however they are likewise in a drop.

Chart J. Incomes cycles and production cycles tend to just be associated throughout crises. ( St Louis Fed; S&P Global; Robert Shiller; Author computations)

Lastly, it is time to move our attention to equities.

The Marketplace Cycle in Stocks

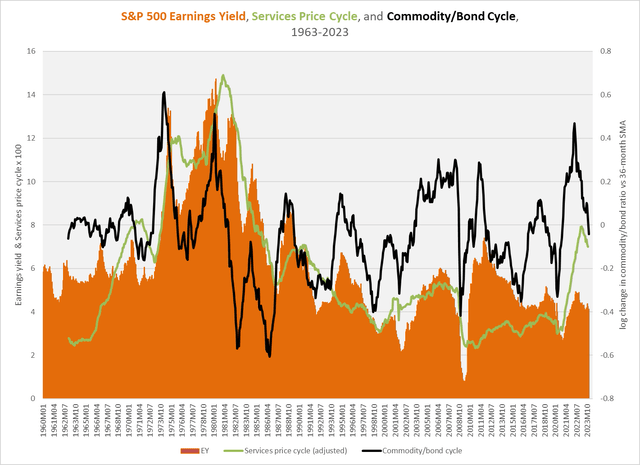

Cyclical relocations in the incomes yield (the inverse of the price/earnings ratio) tend to be driven by modifications in incomes instead of modifications in stock rates, whereas supercyclical modifications in the incomes yield tend to be driven by modifications in stock rates. For that reason, over cyclical periods, the incomes yield tends to move with the marketplace cycle in a way comparable to products.

The chart listed below programs outright levels of the S&P 500 incomes yield together with cyclical modifications in the commodity/Treasury ratio, and cyclical modifications in customer services rates, the main part in customer rates. It is exceptionally uncommon for customer rates to lead the marketplace cycle, and generally they lag.

However, levels of the incomes yield and the cyclical momentum in the commodity/Treasury tend to move together.

Chart K. The incomes yield tends to be associated with the marketplace cycle, while services inflation tends to lag. ( World Bank; St Louis Fed; S&P Global; Robert Shiller; Author computations)

Often stocks are exceptionally conscious the marketplace cycle (as in 2008-2009) and other times, they act in contracyclical methods (as in 1984-1986), increasing as inflation and incomes momentum falls.

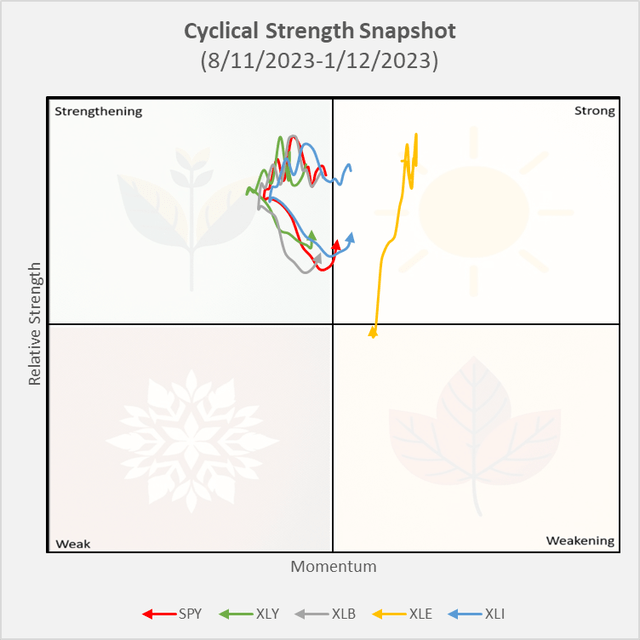

Their strange nature suggests that their cyclical momentum needs to be determined in a various method. In the chart, I take the overall returns of the SPY and a few of the most extremely cyclical sectors– XLY, XLB, XLI, and XLE– and produce combined procedures of their particular momenta and strength relative to long-lasting Treasuries.

Chart L. Equities stay resilient. ( Tiingo.com; Author computations)

For a prolonged time period, other than for a current decrease in XLE’s position, stocks have regularly beat Treasuries, as highlighted by their positions above the horizontal line in the middle of the chart. Although they lost some momentum late in 2015, just like conditions in the fall of 2022, this showed to be mainly a purchasing chance.

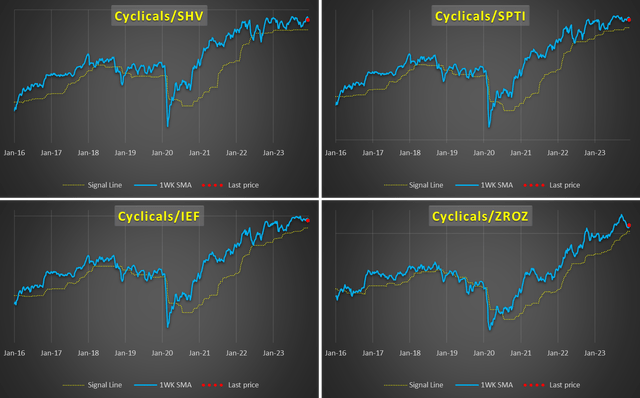

The following chart shows similar story in a rather various method. Here, I have actually produced an equal-weighted index of XLB, XLI, and XLE (that is, “Cyclicals”) and the ratio of that index to 4 Treasury bond ETFs (SHV, SPTI, IEF, and ZROZ). Behind that ratio, I have actually determined what I think is the suitable moving average for such ratios.

Chart M. Cyclical sectors continue to beat United States Treasuries ( Tiingo.com; Author computations)

As you can see, cyclical sectors have actually lost some momentum relative to short-term Treasury ETFs like SHV and SPTI and longer-term Treasury ETFs like IEF and ZROZ, however the patterns stay undamaged.

In amount, it appears that the downcycle that started in products and business incomes in early 2022 stays undamaged and has actually been followed by a deceleration in long-lasting Treasury yields, not to discuss customer inflation cycles. It is just in the last couple of months that we have actually seen Treasury yields start to “capture up” with their own momentum, in addition to the momentum of the marketplace cycle.

Conclusion

In an approaching piece, I will argue that Treasury yields are most likely to decrease in a continual and considerable style this year, which this next stage of the decline is most likely to start in the next couple of months, if not in a matter of weeks. However, that leaves the concern of how stocks will react, both on an outright and relative basis. Current history (the last 20 years particularly) has actually indicated a propensity for stock/bond ratios to follow the marketplace cycle. That is, when yields and products decrease, stock/bond ratios decrease, too, as in the 2018-2019 duration leading up to the Covid crash.

The most uncommon feature of the present cycle, especially because the peak of products and incomes momentum 2 years back is the degree to which rates of interest have actually declined to do the same, despite the fact that rate of interest momentum has. This has actually added to a significant divergence in between the core of the marketplace cycle (incomes development and product inflation) on one side and the periphery of the marketplace cycle (rates of interest and stocks) on the other.

The expectation stays that yields are going to decline decisively and bring stock returns with them; hence, the very best location to be is most likely long-lasting Treasuries. However, keeping an eye on the state of the cycle throughout all possession classes and important macro-variables will be essential.