2024 is forming up to be more active than 2023 for property buyers and sellers, with home loan applications and brand-new listings increasing. However Redfin financial experts think need and listings would be increasing more if not for harsher-than-usual winter season weather condition.

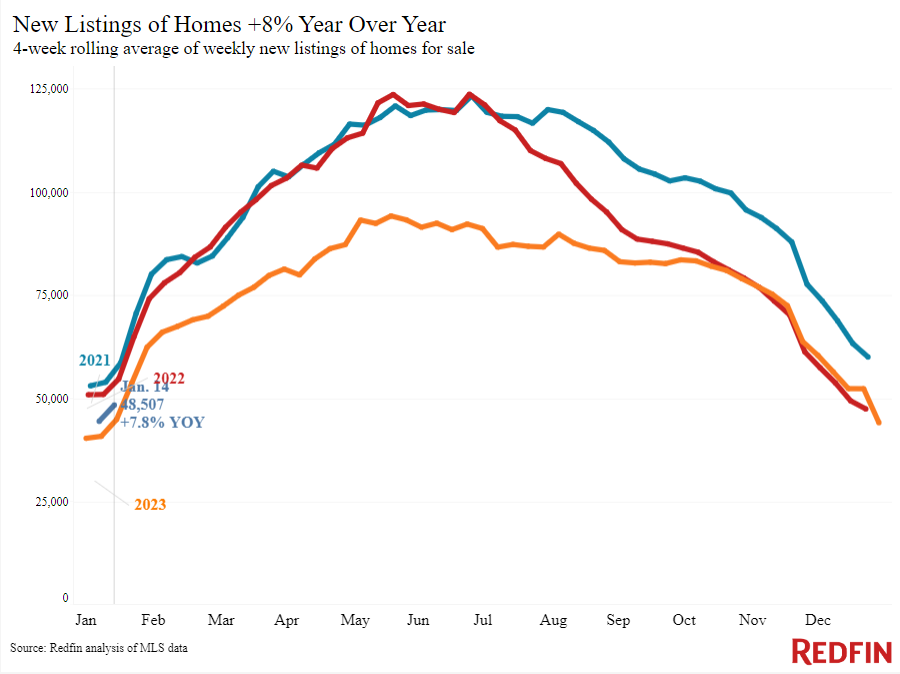

Homebuyers and sellers are slowly ending up being more active as the calendar turns even more into 2024. Mortgage-purchase applications are up 8% from a month earlier, and Redfin representatives report that lower home loan rates are igniting purchasers’ interest. On the sell side, brand-new listings increased 8% year over year throughout the 4 weeks ending January 14.

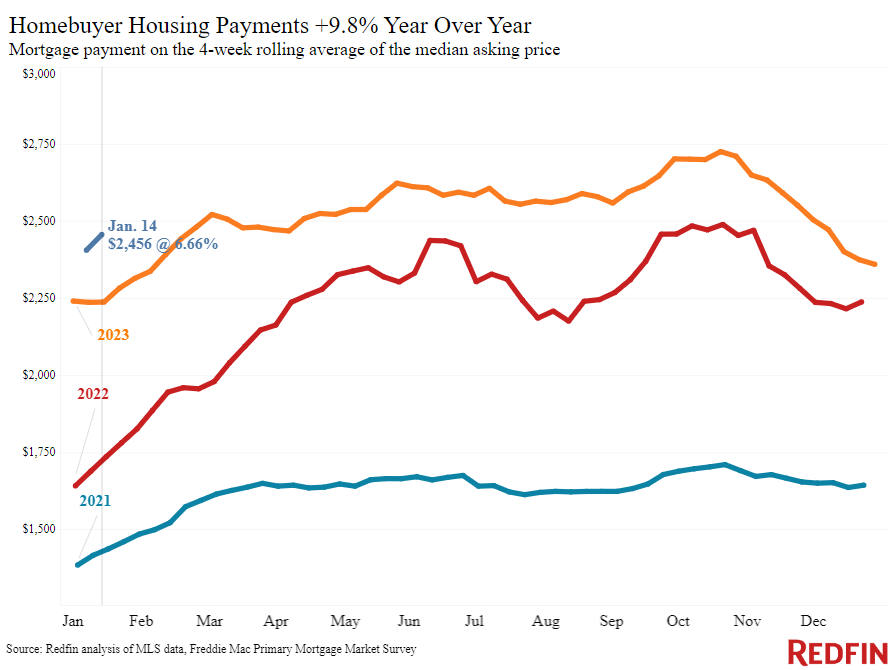

Purchasers and sellers are making relocations mainly since home loan rates are holding constant in the mid-6% variety, below 8% in October. The common U.S. property buyer’s month-to-month real estate payment is $2,456 with this week’s typical rate; while that’s up 10% year over year, it’s below October’s record high of over $2,700.

Redfin financial experts state purchaser need and listings would likely be getting more if not for the serious winter season weather condition much of the nation experienced over the recently. “We anticipated both purchasers and sellers to respond more highly to last month’s drop in home loan rates as soon as the vacations passed, however freezing weather condition and snowstorms have actually stopped a great deal of trading strategies,” stated Redfin Economic Research study Lead Chen Zhao “As long as rates do not soar, we anticipate the marketplace to get as the spring season methods.”

Redfin representatives state climate condition aside, purchasers are feeling more positive. “Individuals who were delicately home searching when rates were greater are buckling down now,” stated Chicago Redfin Premier representative Dan Close “Purchasers are feeling more positive that they can get great worth for their cash, and lots of first-timers are leaping in since Chicago leas are still increasing. House owners who were waiting on the vacations to be over and rates to come down before offering are preparing yourself to list. I have a number of listings prepped to strike the marketplace, some as early as today and some throughout the remainder of the very first quarter.”

Leading indications

| Indicators of homebuying need and activity | ||||

| Worth (if suitable) | Current modification | Year-over-year modification | Source | |

| Day-to-day typical 30-year set home loan rate | 6.88% (Jan. 17) | Up a little from 6.78% a week previously | Up from 6.07% | Home Mortgage News Daily |

| Weekly typical 30-year set home loan rate | 6.66% (week ending Jan. 11) | Near least expensive level given that Might | Up from 6.33% | Freddie Mac |

| Mortgage-purchase applications (seasonally changed) | Up 9% from a week previously; up 8% from a month previously (since week ending Jan. 12) | Down 20% | Home Mortgage Bankers Association | |

| Google look for “home for sale” | Up 10% from a month previously (since Jan. 16) | Down 13% | Google Trends | |

| We omitted Redfin’s Property buyer Need Index today to guarantee information precision | ||||

Secret housing-market information

| U.S. highlights: 4 weeks ending January 14, 2023

Redfin’s nationwide metrics consist of information from 400+ U.S. city locations, and is based upon homes noted and/or offered throughout the duration. Weekly housing-market information returns through 2015. Topic to modification. |

|||

| 4 weeks ending January 14, 2023 | Year-over-year modification | Notes | |

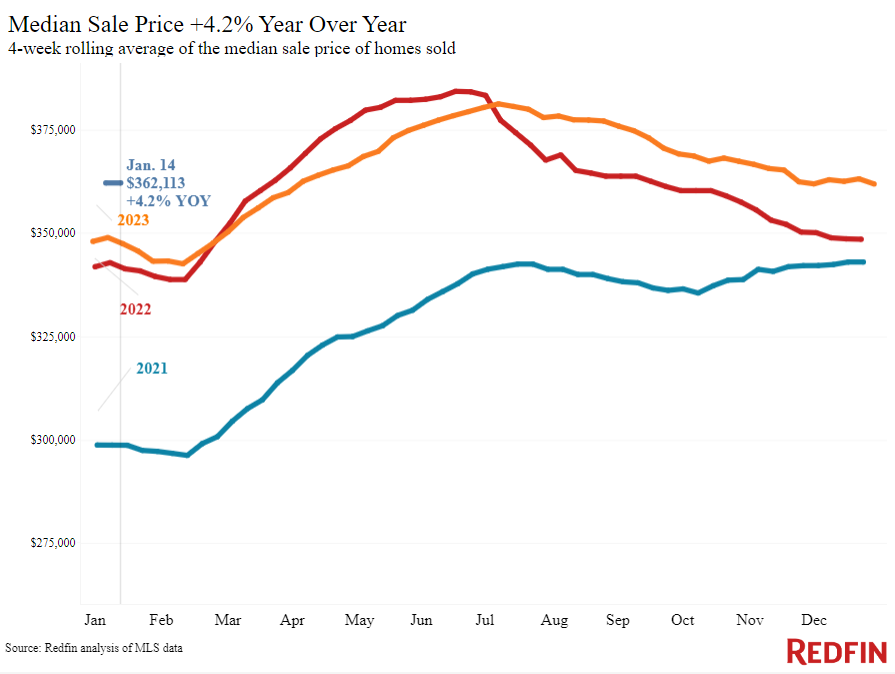

| Mean list price | $ 362,113 | 4.2% | |

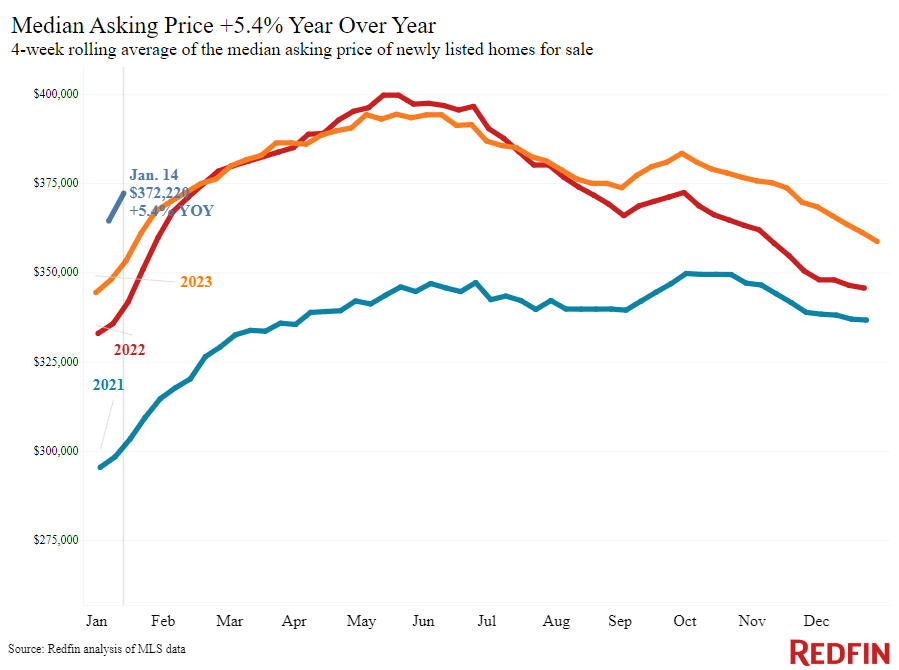

| Mean asking cost | $ 372,220 | 5.4% | |

| Mean month-to-month home loan payment | $ 2,456 at a 6.66% home loan rate | 9.8% | Down almost $300 from all-time high set throughout the 4 weeks ending Oct. 22 |

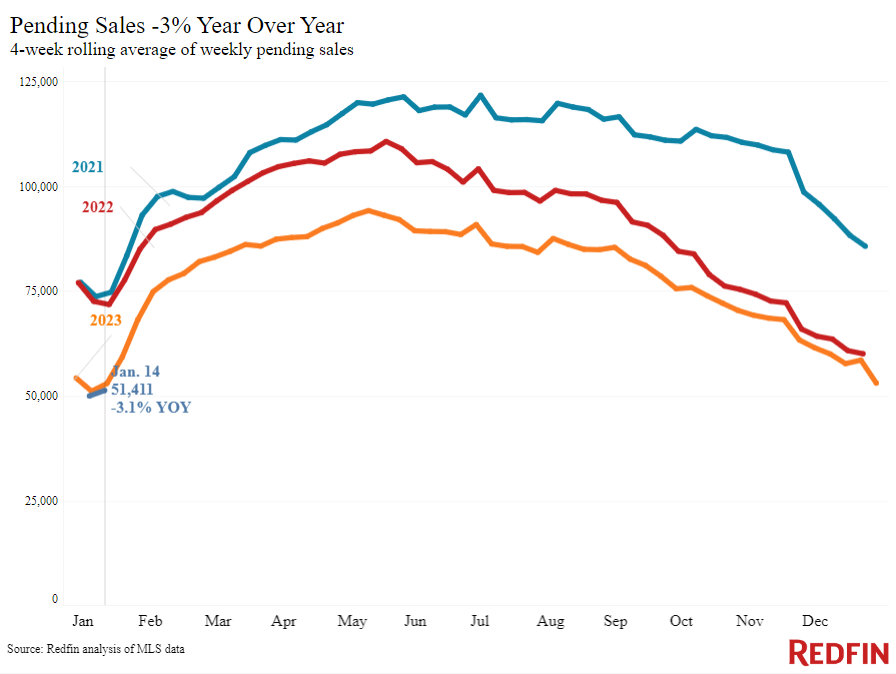

| Pending sales | 51,411 | -3.1% | |

| Brand-new listings | 48,507 | 7.8% | |

| Active listings | 762,737 | -2.4% | Tiniest decrease given that June |

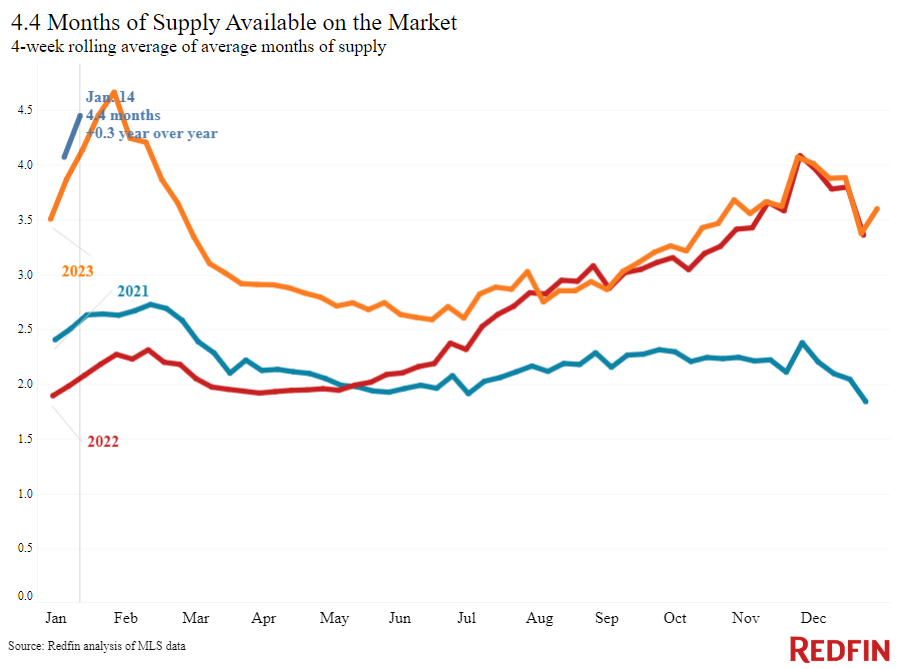

| Months of supply | 4.4 months | +0.3 pts. | 4 to 5 months of supply is thought about well balanced, with a lower number suggesting seller’s market conditions. |

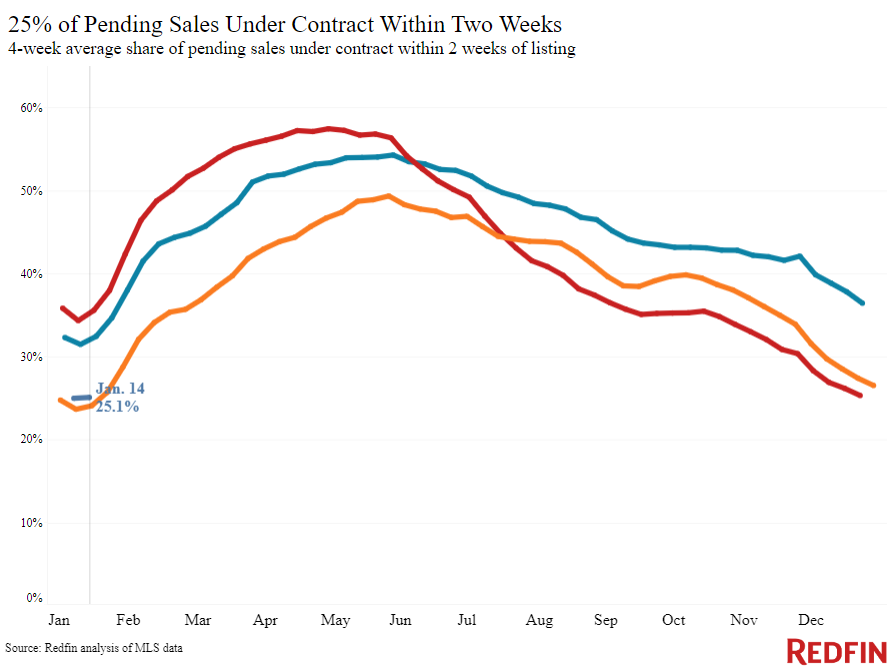

| Share of homes off market in 2 weeks | 25.1% | The Same | |

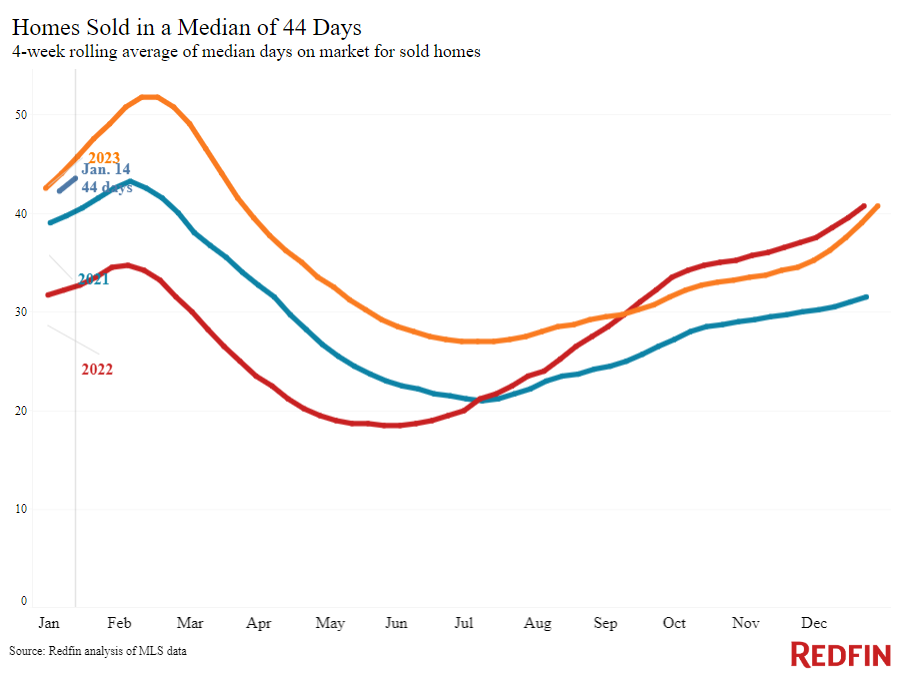

| Mean days on market | 44 | -2 days | |

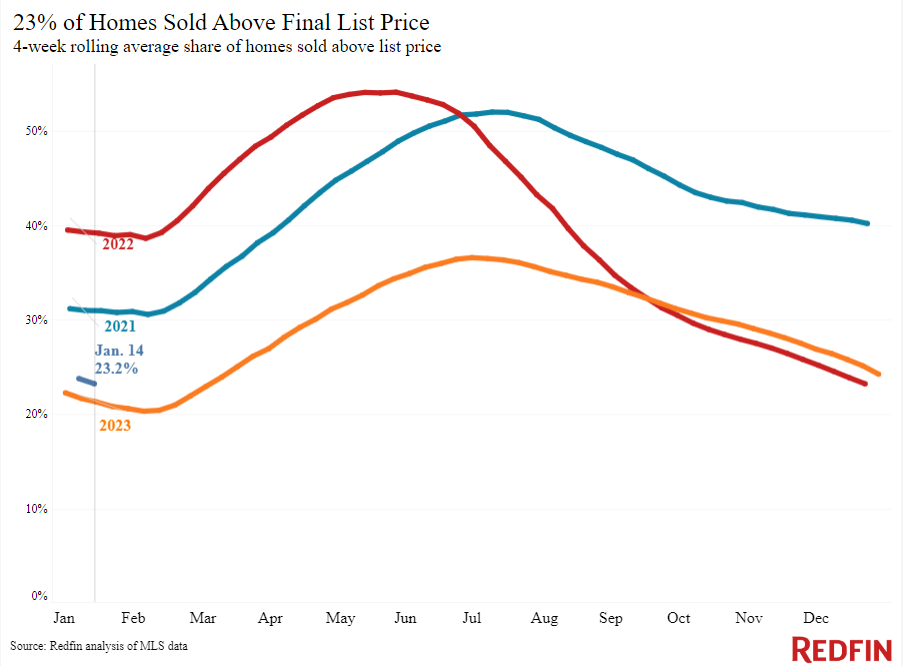

| Share of homes offered above sale price | 23.2% | Up from 21% | |

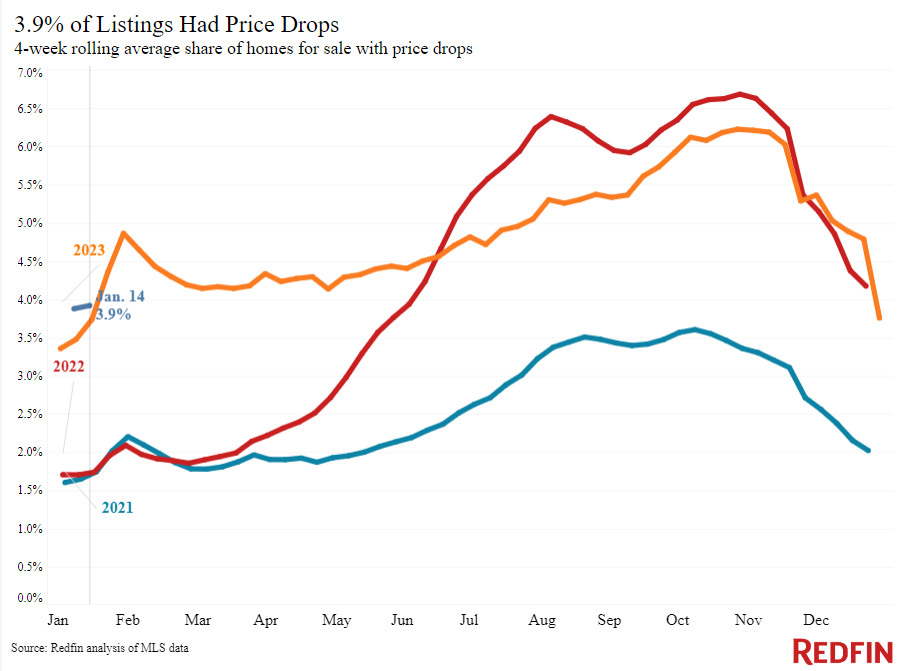

| Share of homes with a rate drop | 3.9% | +0.2 pts. | |

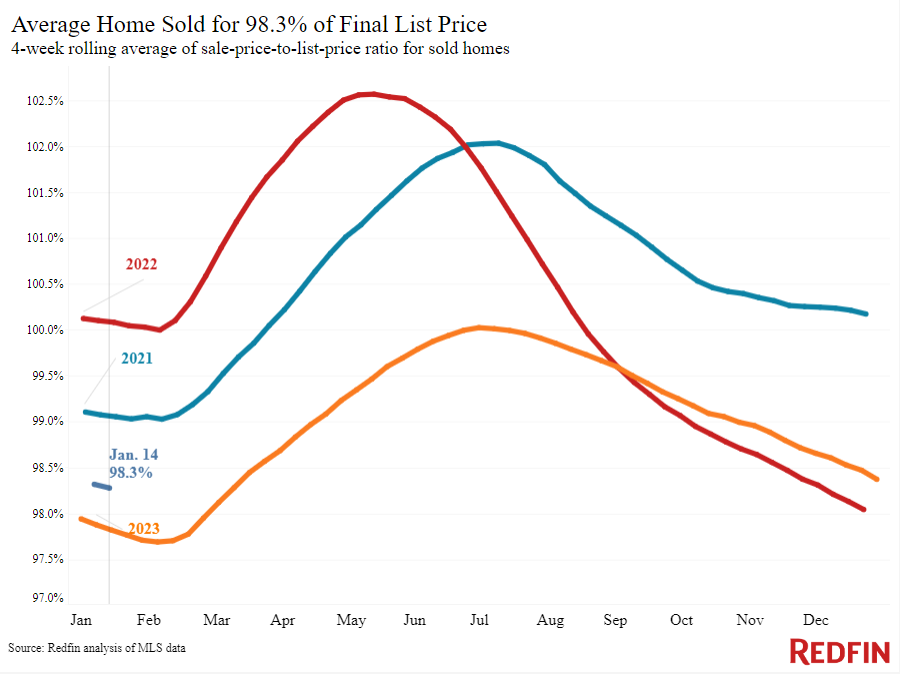

| Typical sale-to-list cost ratio | 98.3% | +0.5 pts. | |

|

Metro-level highlights: 4 weeks ending January 14, 2023 Redfin’s metro-level information consists of the 50 most populated U.S. cities. Select cities might be omitted from time to time to guarantee information precision. |

|||

|---|---|---|---|

| Metros with most significant year-over-year boosts | Metros with most significant year-over-year reductions | Notes | |

| Mean list price |

Anaheim, CA (16.6%) West Palm Beach, FL (14.8%) Newark, NJ (14.1%) Fort Lauderdale, FL (13.1%) Miami (12.8%) |

Oakland, CA (-3.4%) Austin, TX (-2.8%) Fort Worth, TX (-0.3%) San Antonio, TX (-0.1%) |

Decreased in 4 cities |

| Pending sales | San Jose, CA (10.6%)

Detroit (9.5%) Milwaukee, WI (6.1%) Columbus, OH (5.6%) Pittsburgh, PA (4.7%) |

Newark, NJ (-14.3%)

New Brunswick, NJ (-13.9%) New York City (-13.2%) San Diego (-12.2%) West Palm Beach, FL (-11.3%) |

Increased in 13 cities |

| New listings | Phoenix (24.4%)

Minneapolis, MN (22.1%) Pittsburgh, PA (19.1%) Houston (18.6%) San Antonio, TX (17.6%) |

Chicago (-13.8%)

Atlanta (-10.2%) Newark, NJ (-7.3%) Providence, RI (-7.1%) Portland, OR (-5.6%) |

Decreased in 10 cities |

Describe our metrics meaning page for descriptions of all the metrics utilized in this report.