The UK is now well into a 2nd years of slow performance development, with significant repercussions for individuals’s standard of life, for the sustainability of civil services, and (perhaps) for the broader political environment. It has actually ended up being typical to date the start of this brand-new duration of sluggish performance development to the worldwide monetary crisis around 2008, however I progressively presume that the roots of the despair were currently in location previously in the 2000s.

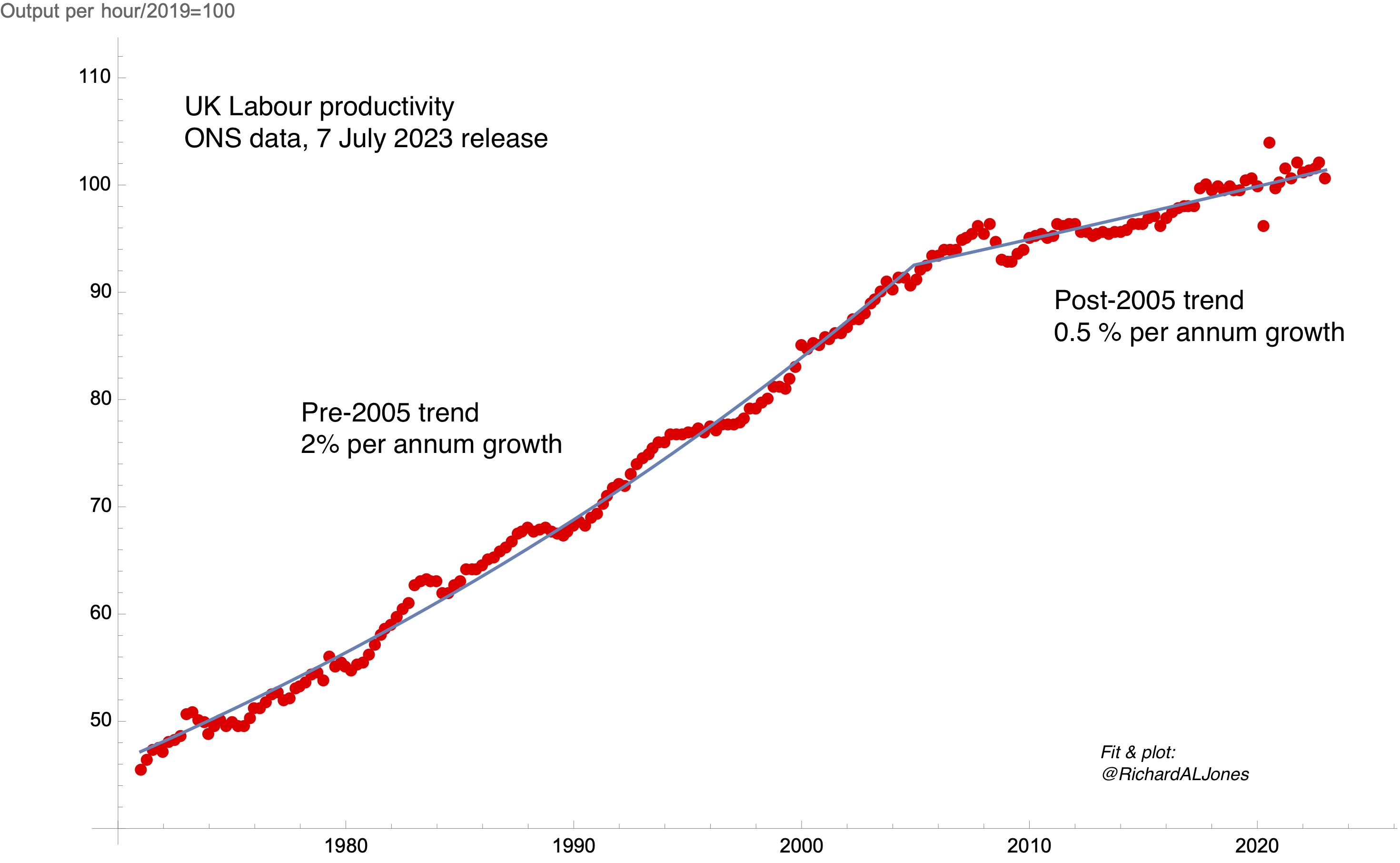

UK Labour performance. Information: ONS, Output per hour worked, chained volume step, 7 July 2023 release. Fit: non-linear least squares fit to 2 rapid development functions, constant at break point. Finest in shape break point is 2004.9.

My plot reveals the current release of whole-economy quarterly performance information from the ONS. I have actually fitted the information to a function representing 2 durations of rapid development, with various time constants, constrained to be constant at a time of break. There are 4 fitting criteria in this function– the 2 time constants, the level at the break point, and the time of break. My finest fit reveals a break point at 2004.9.

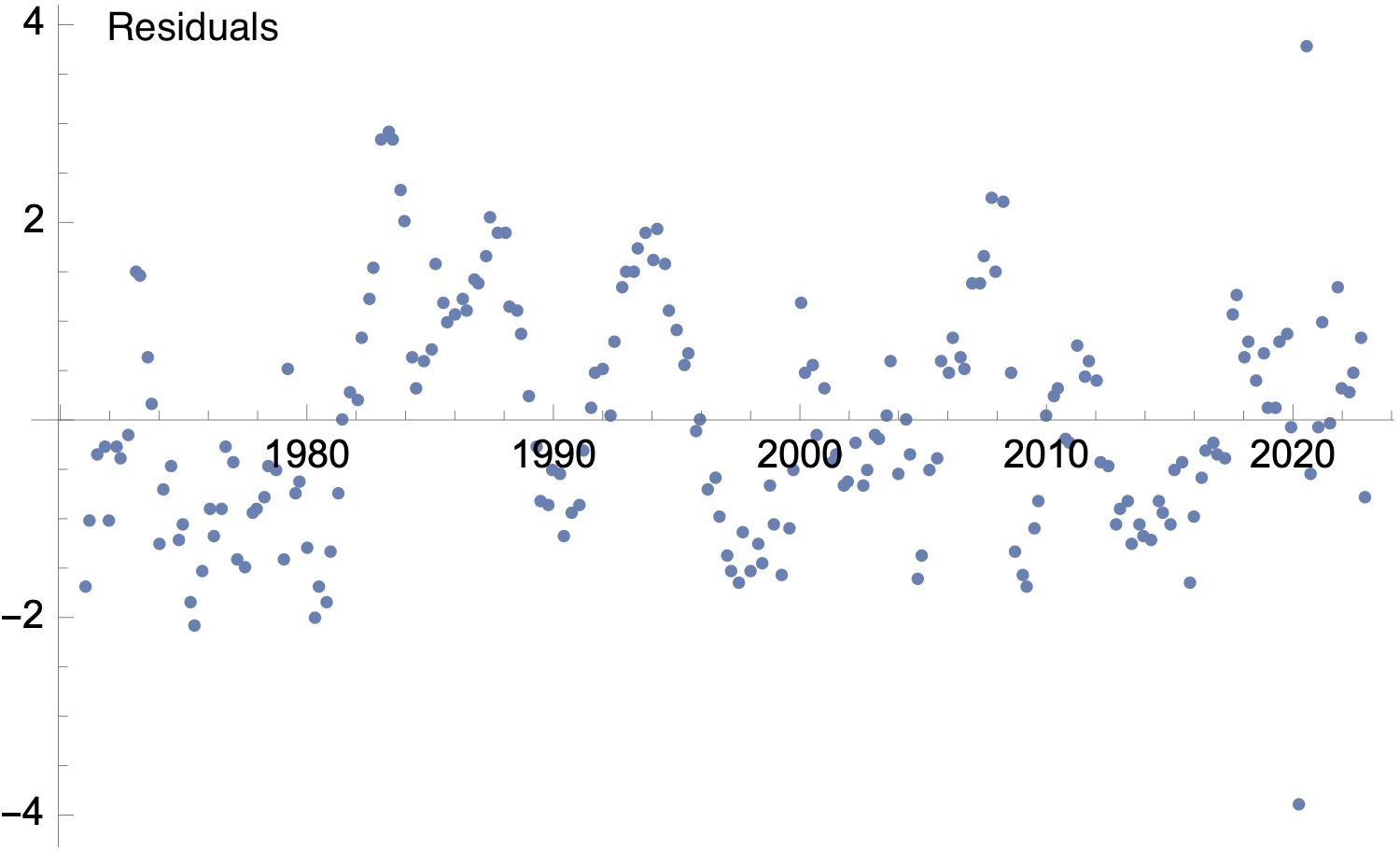

Residuals for the fit to the quarterly performance information revealed above.

The plot of the residuals to the fit is revealed above. This reveals that the goodness of fit is similar throughout the entire time variety (with the exception of the spikes representing the result of the pandemic). There are variances from the fit representing the result of booms and economic downturns, however the variances around the time of the International monetary crisis are similar with those in earlier boom/bust cycles.

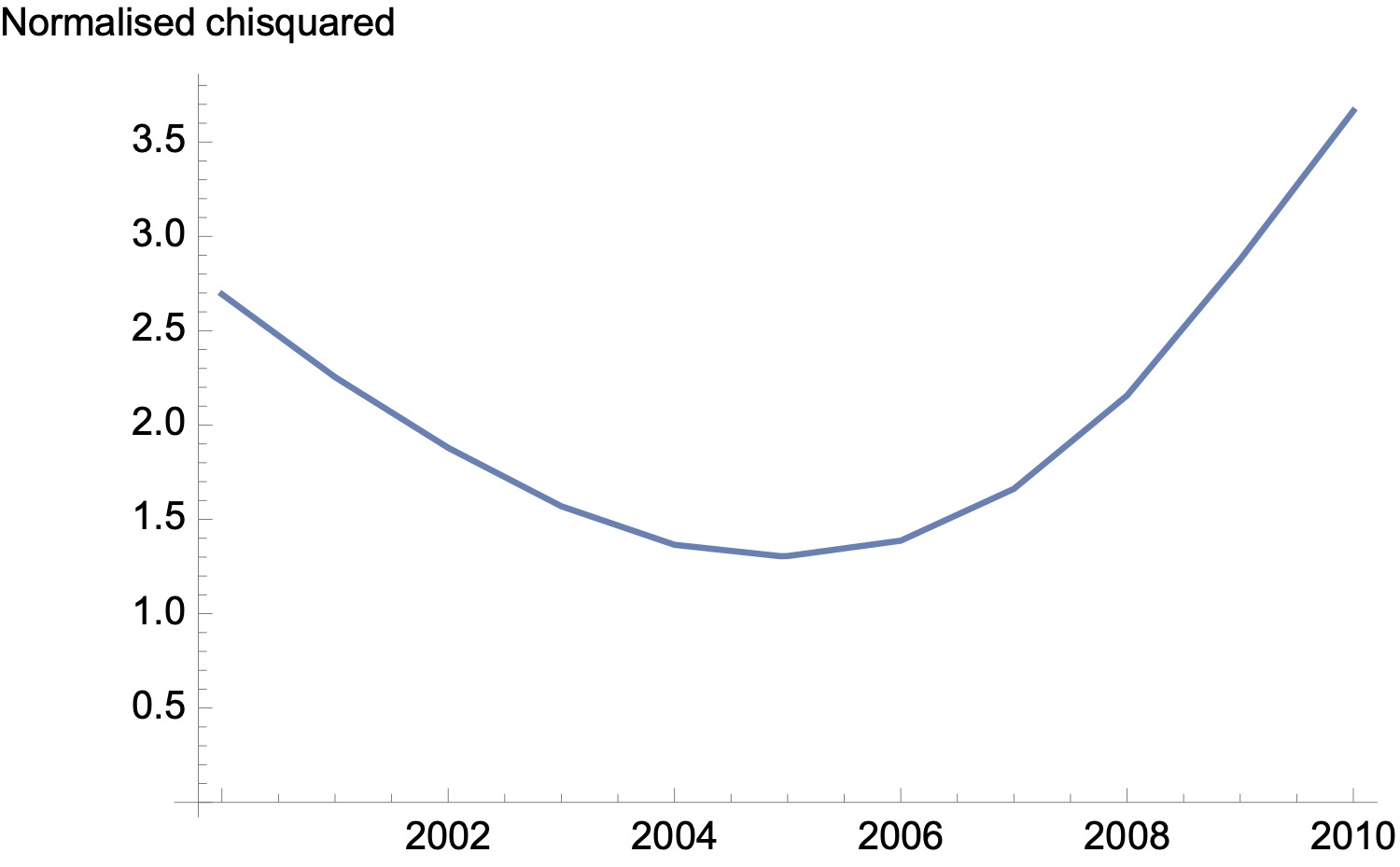

How delicate is the fit to the timing of the break point? I have actually redone the fits constraining the year of the break point, and computed at each point the normalised chi-squares (i.e. the amount of the squared distinctions in between information and design, divided by the variety of information points). This is revealed listed below.

Normalised chi-squared– i.e. amount of the squares of the distinctions in between performance information and the 2 rapid design, for fits where the time of break is constrained.

The goodness of fit differs efficiently around an optimal worth of the time of break near 2005. A time of break at 2008 produces a materially even worse quality of fit.

Can we measure this additional and connect a likelihood circulation to the year of break? I do not believe so utilizing this method– we have no factor to expect that the variances in between design and fit are drawn from a Gaussian, which would be the presumption underlying conventional techniques to ascribing self-confidence limitations to the fitting criteria. I think there are Bayesian techniques to resolving this issue, and I will check out those for additional work.

However for now, this leaves us with a hypothesis that the character of the UK economy, and the worldwide context in which it ran, had actually currently made the shift to a low performance development state by the mid-2000’s. In this view, the monetary crisis was a sign, not a cause, of the performance downturn.