alvaro gonzalez/Moment through Getty Images

As a worth financier, I’m constantly on the lookout for the next appealing chance. Oftentimes, I wind up handing down the business that I take a look at. In an unusual choose couple of cases, I do discover a possibility that is appealing enough to purchase into. My search eventually brought me to a relatively little local bank called Provident Financial Solutions ( NYSE: PFS). Just recently, monetary efficiency accomplished by the organization has actually been blended. However the bright side is that shares are trading at appealing levels. However there is another level of intricacy here. Which includes a significant deal that the organization remains in the procedure of finishing. For those who are bullish on business, this deal might unlock for some extra gains also.

A fascinating bank seeing fascinating modifications

For those not acquainted with Provident Financial Solutions, a bit of information about the business and its operations would most likely be important. Simply put, Provident Financial Solutions is a monetary holding business that was established in early 2003. A mix of natural development and acquisitions have actually increased the business to the size that it is today. For context, that includes $10.29 billion worth of deposits. Although the bank was established 21 years earlier, it really traces its roots back to 1839. And although it has actually altered a lot throughout the years, it does offer its clients with the conventional banking items that you would anticipate.

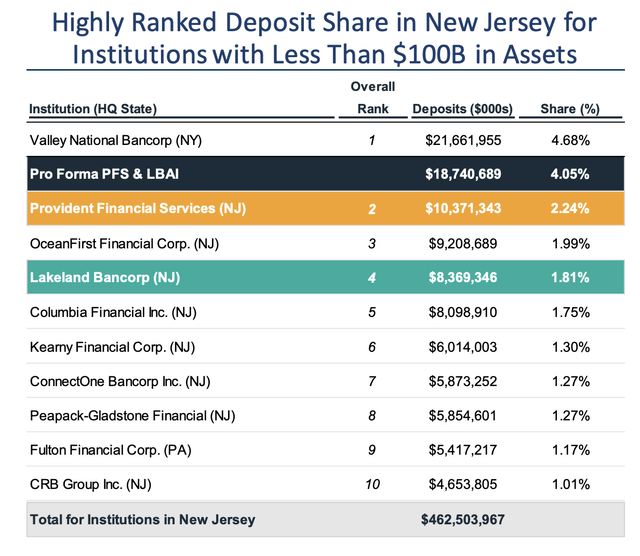

For example, the business provides deposit and examining accounts. It supplies a large range of loans such as business property loans, property mortgage, customer loans, and more. The organization makes financial investments in other kinds of properties also, such as mortgage-backed securities. And on top of all of this, it supplies fiduciary and wealth management services to its clients, in addition to insurance coverage brokerage services. In regards to geographical focus, the business is found out of New Jersey. Since completion of the 2022 , it ran a network of 95 full-service banking workplaces that were spread out throughout 14 various counties in parts of New Jersey, in addition to in 3 counties in Pennsylvania and 2 in New york city. It has some satellite loan production workplaces spread out throughout a couple of various locations also. In New Jersey, where the organization does the majority of its service, it boasts a 2.24% share of the deposits of all clients that have their funds in banks that have less than $100 billion in properties. Utilizing this procedure, it makes it the 2nd biggest organization in its size variety throughout the state.

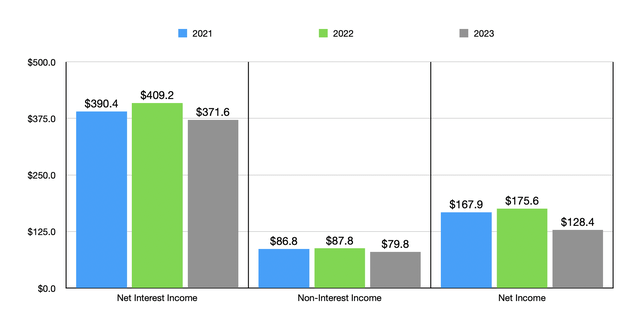

Author – SEC EDGAR Data

Current monetary efficiency accomplished by the bank has actually been rather combined. After seeing net interest earnings increase from $390.4 million in 2021 to $409.2 million in 2022, that number then plunged to $371.6 million in 2015. Although the business delighted in a boost in properties from 2022 to 2023, it struggled with a decrease in its net interest margin from 3.37% to 3.16%. Although the yield that it had the ability to get on interest making properties grew from 3.76% to 4.87%, the typical expense of interest bearing liabilities increased from 0.54% to 2.24% over the exact same window of time, mostly as an outcome of greater rates of interest on its financial obligation, a boost in the quantity of financial obligation on its books, and an increase in just how much it needed to compensate depositors to keep their funds at the organization. Comparable weak point can be seen when taking a look at both non-interest earnings and net earnings as we go from 2022 to 2023.

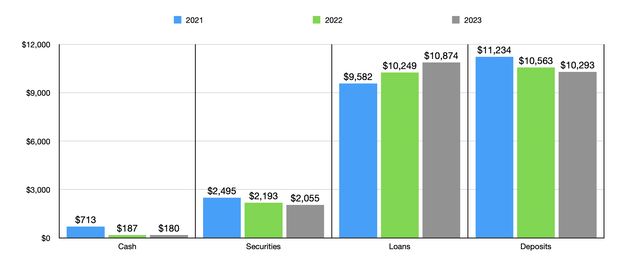

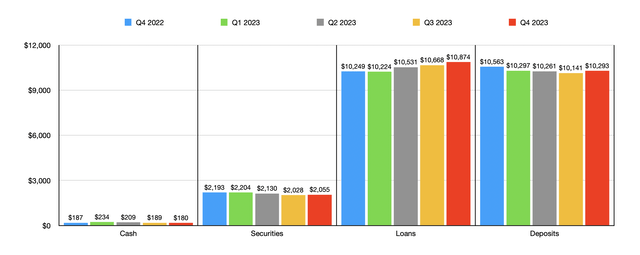

Mentioning deposits, one weak location of the bank over the last few years has actually been the overall worth of deposits. These dropped from $11.23 billion in 2021 to $10.56 billion in 2022. 2023 saw an additional drop to $10.29 billion. Nevertheless, the last quarter of the year really revealed a healing compared to the decrease that the organization had actually seen for no less than 4 straight quarters prior to that. In addition to experiencing a banking crisis in 2015, the market has actually likewise been pestered with extreme competitors for deposits. High rates of interest have actually led to depositors looking somewhere else for appealing returns. So it is not unusual to take a look at an organization that, over a year or more, has actually seen some weak point on this front. However it’s absolutely not something you wish to see.

Author – SEC EDGAR Data

Although the worth of deposits has actually decreased, the worth of loans has actually just increased. After climbing up from $9.58 billion in 2021 to $10.25 billion in 2022, we saw an additional boost in each quarter from the 2nd quarter of 2023 through the last quarter of 2023. By the end of the year, loans can be found in at $10.87 billion. This is not to state that whatever has actually increased. As the chart above shows and as the chart listed below shows, the worth of securities has actually continued to decrease in many quarters, though there was a modest uptick in the last quarter of in 2015. And the worth of money, after 2021, stayed in a relatively narrow variety although we saw a quite constant decrease from the very first quarter of 2023 through the last quarter of the year.

Author – SEC EDGAR Data

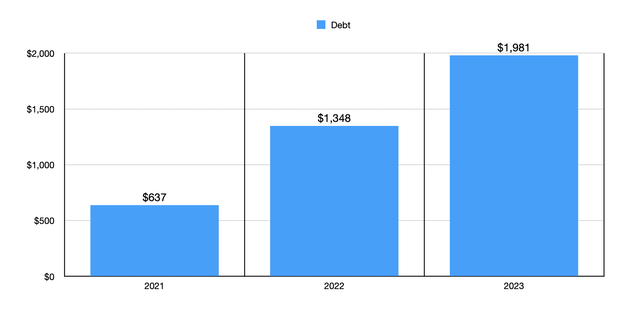

Another fascinating subject is financial obligation. After seeing financial obligation dive from $637.1 million in 2021 to $1.35 billion in 2022, financiers may have anticipated a decrease. Nevertheless, even in spite of greater rates of interest, financial obligation has actually increased even more. By the end of the 2023 , it had actually grown to $1.98 billion. A few of this is most likely in reaction to the issues that have actually pestered the sector. Banks did pack up on financial obligation throughout much of in 2015, deciding to keep the money on hand to ensure depositors that the companies were sufficiently capitalized. Nevertheless, I do not see why this would be such a significant issue as far as Provident Financial Solutions goes. Although last quarter information for 2023 has not come out for this specific procedure, we do understand that since completion of the 3rd quarter, 24.6% of all deposits were uninsured. This is listed below the 30% optimum that I like to see. And it likewise indicates that the likelihood of a bank operate on deposits is restricted.

Author – SEC EDGAR Data

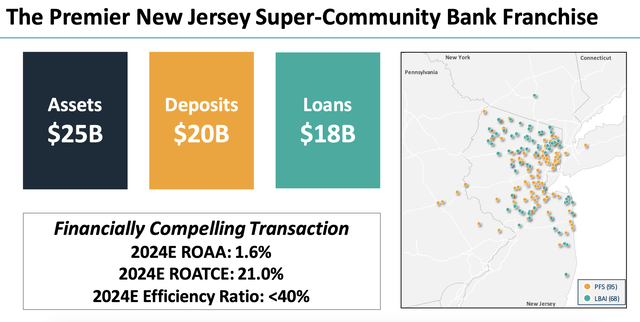

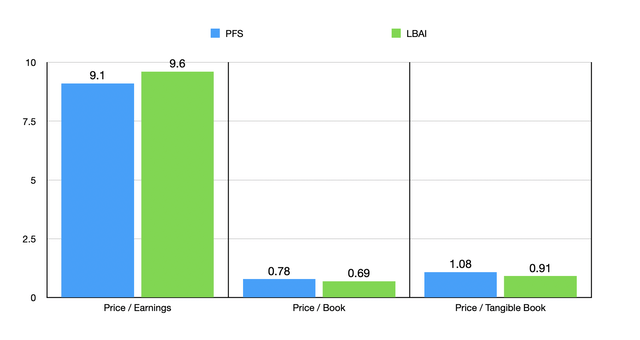

In regards to how shares are priced, I can just state that the stock looks inexpensive. If we utilized arise from the 2023 , the organization is trading at a rate to incomes multiple of 9.1. The rate to book multiple is 0.78 while the rate to concrete book worth is 1.08. Now, in addition to that being appealing, there’s likewise the truth that the organization has an intriguing driver. Back in September of 2022, management revealed that Provident Financial Solutions would efficiently be taking in Lakeland Bancorp ( LBAI) in an all-stock deal where investors of Lakeland Bancorp would get 42% of the combined business, while investors of Provident Financial Solutions are slated to get the bulk 58% ownership.

Provident Financial Solutions

Late in 2015, the 2 business brought out a joint news release stating that they stay dedicated with the merger and they are working to see that it pertains to fulfillment. Presuming that it does, it will set the phase for an even bigger business. At the time the offer was revealed, Lakeland Bancorp had $8.37 billion worth of deposits, making it the fourth biggest gamer in New Jersey that has less than $100 billion in properties. Lakeland Bancorp brings with it specific activities that Provident Financial Solutions never ever truly established a proficiency in. Examples consist of asset-based financing, devices lease funding, home mortgage storage facility financing, and more. This will produce a more total banks that can offer its clients with many anything they require.

Provident Financial Solutions

Management likewise has high wish for what this deal might suggest for earnings progressing. They are forecasting, for example, annualized expense savings of $65 million from the deal. The close distance of these banks will assist to enable these cost savings. About 75% of those cost savings will be acknowledged throughout the very first 9 months following the conclusion of the merger. And this does not consist of any possible profits synergies. These synergies are anticipated to assist grow net earnings for investors from $198 million on a standalone basis for Provident Financial Solutions to $424 million yearly. Just $137 countless the $226 million enhancement is driven by the standalone incomes related to Lakeland Bancorp. The rest is related to synergies and other modifications.

Naturally, Lakeland Bancorp does not seem a dreadful chance either. In truth, the all-stock nature of the proposed deal now indicates that purchasing it might be the like purchasing Provident Financial Solutions at a discount rate so long as the offer is finished as concurred upon. At today minute, shares of Lakeland Bancorp are trading at a 17.8% discount rate to the suggested buyout rate. And as you can see in the chart below, shares of the business are priced really likewise to what Provident Financial Solutions is priced at now.

Author – SEC EDGAR Data

Takeaway

For financiers in the banking sector they wish to blend things up, Provident Financial Solutions produces an intriguing possibility. It holds true that monetary efficiency has actually been rather combined since late, especially from a profits and revenue point of view. The current uptick in deposits is motivating, as is the ongoing development in loans. However there are some things I do not like, such as the growing financial obligation. The bright side is that shares are priced at rather appealing levels. However for those who desire a little additional advantage and who do not mind the threat that a prepared merger brings, purchasing Lakeland Bancorp is the exact same as purchasing Provident Financial Solutions at a discount rate.