Weekly highlights

- Asia-US West Coast costs (FBX01 Weekly) increased 11% to $ 4,859/ FEU

- Asia-US East Coast costs ( FBX03 Weekly) climbed up 3% to $ 6,589/ FEU

- Asia-N. Europe costs ( FBX11 Weekly) fell 8% to $ 4,697/ FEU

- Asia-Mediterranean costs ( FBX13 Weekly) fell 7% to $ 5,758/ FEU

- China– N. America weekly costs reduced 35% to $ 3.91/ kg

- China– N. Europe weekly costs increased 13% to $ 3.51/ kg

- N. Europe– N. America weekly costs fell 1% to $ 2.03/ kg

Dive much deeper into freight information that matters

Remain in the understand in the now with immediate freight information reporting

Analysis

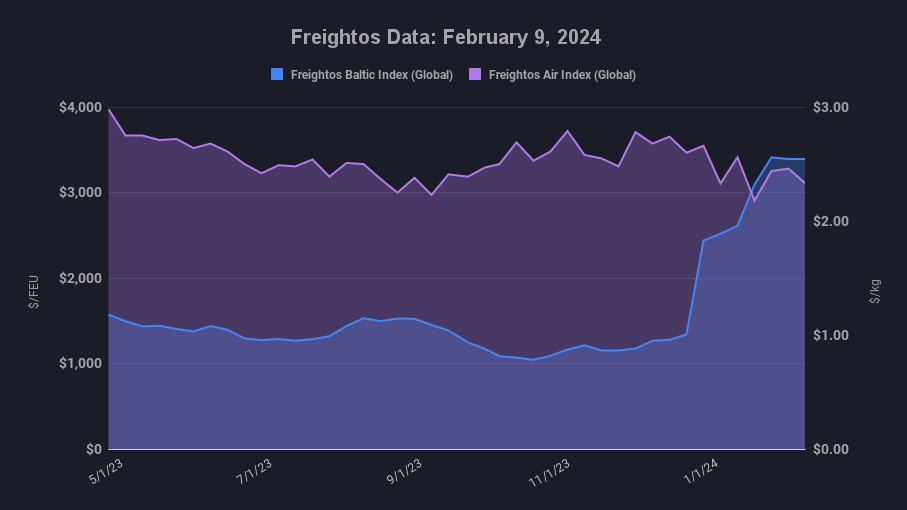

Pressure on ocean operations continued to reduce recently as the pre-Lunar New Year rush concerned an end, more empty containers showed up back at export centers, and schedules support as providers include vessels to accommodate diverted lanes with longer ranges to cover.

A survey of logistics specialists who attended our current Red Sea Crisis Update webinar recently discovered 80% believe the worst of the effect on container traffic and rates lags us, with a 3rd anticipating disturbance levels and ocean rates to decrease in the coming weeks.

Ocean rates from Asia to N. Europe and the Mediterranean both dipped about 7% recently and are 15% lower than their late January peaks as conditions enhance and require declines. Costs to N. America continued to climb up recently, though not as greatly as in January, with everyday rates up until now today revealing some leveling off.

Before the Red Sea crisis began, overcapacity from continual fleet development had actually been the huge story in ocean freight and the primary motorist of plunging rates. However diversions far from the Suez Canal have providers utilizing more ships to get used to longer transits and keep to their weekly departure schedules, which has actually soaked up much of that otherwise excess capability. The requirement for more active capability saw the variety of idle big ships drop to no recently, and has actually even caused a rebound in the charter market.

Providers had actually prepared for that the ripple effects of moving capability to Red Sea lanes would suffice to press rates up on non-Suez trade too. Transatlantic costs did climb up 25% recently to $1,500/ FEU, which is substantial, however is still listed below successful levels for providers and well except the $5k/FEU GRIs revealed last month by some providers.

However even with the Red Sea diversions taking in capability and N. America need anticipated to grow relative to in 2015 and to 2019, overcapacity looms. Maersk quotes that a resuming of the Red Sea in the near term would result in a sharp decline in rates as supply would overtake need, while, if diversions continue, rates will however fall slowly throughout the year as brand-new capability continues to go into the marketplace.

More providers are resuming Panama Canal transits as conditions there have actually supported and will ideally enhance with the start of the rainy season in May– another element that ought to reduce the Red Sea crisis effect on N. American ocean trade.

In air freight, volumes increased in late January on pre-LNY need in addition to some shift to air due to the Red Sea crisis A boost in sea-air choice need has actually pressed Freightos Air Index rates from Dubai to some European centers up 35% given that the start of the year. Improvements in ocean operations and the arrival of LNY though saw China– N. America rates fall greatly recently to less than $4/kg.

Freight news takes a trip faster than freight

Get industry-leading insights in your inbox.