Among The Fed’s preferred inflation signs – Core PCE Deflator – was up to +3.5% YoY in October from +3.7% in Sept (its most affordable because April 2021). Heading PCE toppled to +3.00% YoY (listed below the 3.1% exp) …

Source: Bloomberg

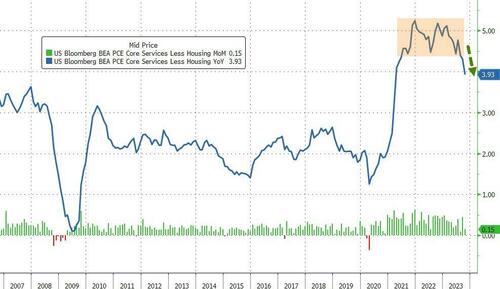

Much more concentrated, is the Fed’s view on Provider inflation ex-Shelter, and the PCE-equivalent programs that it has broken down from its ‘sticky’ levels to its most affordable because March 2021 …

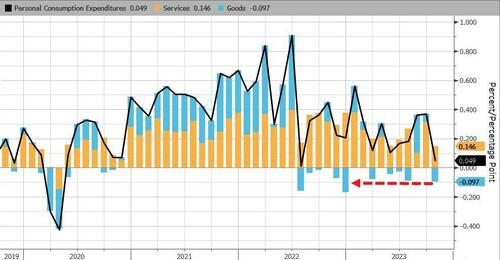

The Item sector saw deflation in October (-0.1% MOMMY – most significant mommy decrease because Dec 2022) while Providers slowed to +0.15% MOMMY …

Source: Bloomberg

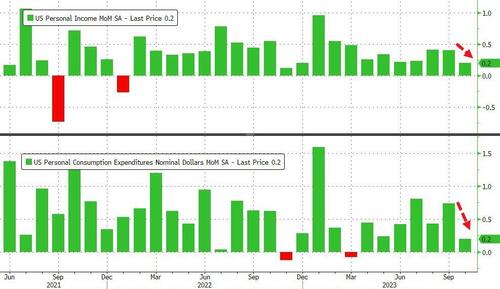

Both earnings and costs development slowed on a mother basis (both +0.2% MOMMY) …

Source: Bloomberg

Earnings development at 4.5% YoY is the slowest because Dec 2022 and Investing development at +5.3% YoY is the slowest because Feb 2021 …

Source: Bloomberg

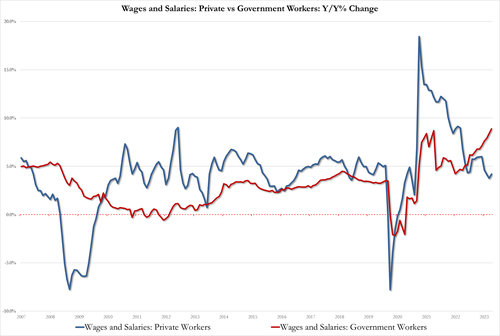

However federal government wage development continued to speed up at a record speed …

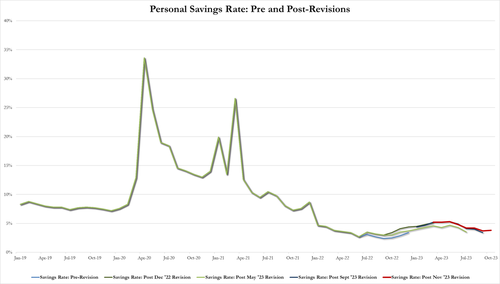

The cost savings rate ticked up to 3.8% of DPI in October …

Source: Bloomberg

Yet another modification with September’s rate brought up from 3.4% to 3.7% …

Is the customer lastly drawing back … or simply reaching the limitation on every source of credit?

Filling …