India’s import of Ural petroleum struck a brand-new high in July as Indian refiners, especially State-run oil marketing business (OMCs), stockpiled on the grade fearing supply disturbances throughout August and September as Russia limitations exports to support rates and fulfill domestic need.

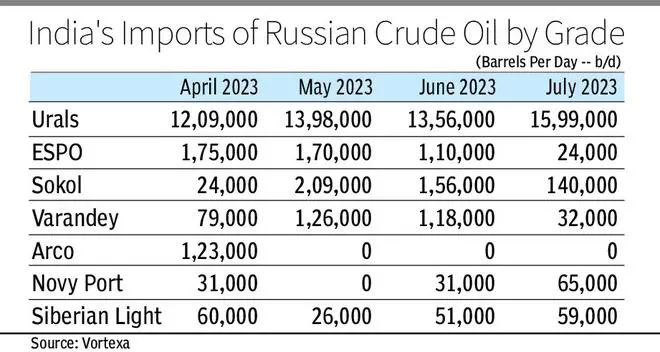

According to energy intelligence company Vortexa, Indian refiners imported around 1.6 million barrels each day (mb/d) of the medium sour grade last month, greater by 18 percent compared to June and 14 percent greater than the record in May 2023.

India’s choice for Russia’s biggest export grade, Ural, can be assessed from the reality that its imports are close to the combined deliveries by the other 3 leading providers– Iraq, Saudi Arabia and the UAE– at 1.67 mb/d.

State-run OMCs represented 63 percent, or 1.21 mb/d, of the overall petroleum imported by India from the erstwhile Soviet Union throughout July at 1.92 mb/d with personal refiners representing the staying freights.

Indian refiners.

Vortexa information reveals that Indian refiners majorly reduced premium light sweet grades such as ESPO, Varandey and Sokol (limited decrease) in July 2023. Besides, the import of other light sweet crude, Novy Port doubled, while that of the lighter grade Siberian Light was greater partially.

” With Russia increase its refinery runs post upkeep to fulfill domestic need and cutting unrefined production, the nation’s unrefined exports have actually obviously fallen. Russian unrefined exports in July are down almost 650,000 b/d versus the peak seen in April/ Might,” Vortexa’s Head of APAC Analysis, Serena Huang informed businessline

Unrefined exports.

Unrefined exports might pull away even more if Russia continues to raise its domestic refinery runs in August, she prepared for.

Previously this year, Russia revealed a cut of 500,000 barrels each day (b/d) from February 2023 levels till end-2023. Consequently, in July it revealed another cut of 500,000 b/d for August. Urals, Russia’s flagship export grade, will represent the majority of the cuts.

Mission for Urals.

A State-run OMC authorities stated competitors for Ural is anticipated to continue. Russian supply disturbances, particularly for Urals, are anticipated for the next 2 months a minimum of. Greater volumes by refiners is to offset the lag in the coming months.

” Indian refiners will continue to lap up any offered Urals. Existing discount rate is around $2-3 per barrel versus Brent, which is still an excellent proposal. Even if the cost cap is breached, India and Russia will discover opportunities to continue trading. What requires to be seen is the international cost rally as Brent is once again at $85 level,” the authorities described.

Vortexa’s Huang mentioned “With decreased Russian crude exports, we might either see lower materials to India or volumes to India holding up at the expenditure of China’s share. The result will eventually be identified by cost and politics.”

Another personal refinery authorities stated with the summertime season in Russia, the nation’s need for fuel has actually increased and refiners are back online post upkeep. Thus lower volumes of Urals are offered for trade.

” Conversations with traders and business authorities suggest that the October-December duration will once again see increasing accessibility of Urals. However premium light grades are offered,” the authorities included.

.