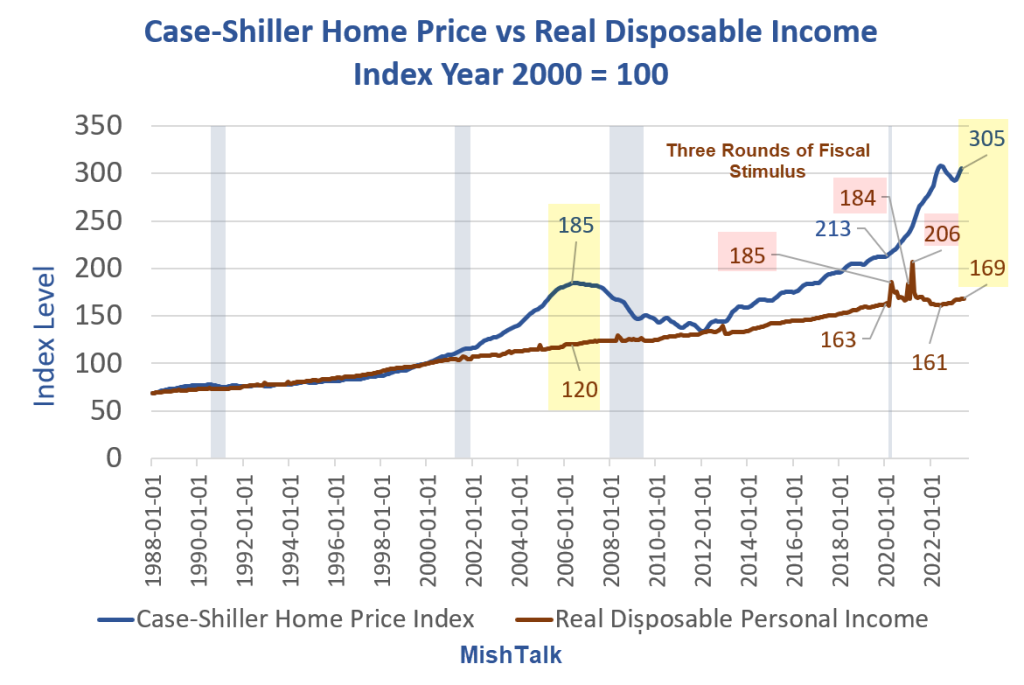

Some reject there is a real estate bubble. I think the bubble is apparent.

Chart Notes

- Case-Shiller is a procedure of repeat sales of the very same home. This is a far much better procedure than typical or average rates that extensively differ in time by house size and features.

- Non reusable ways after taxes

- Genuine ways inflation changed utilizing the BEA’s Personal Intake Expenses (PCE) inflation index, not the BLS Customer Cost Index (CPI).

- Both indexes are set to 2000= 100.

- Case-Shiller is through May (reflective of March) while Genuine DPI is through June. There is a small little alter that I did not consider.

For a minimum of 12 years, house rates followed exceptionally carefully to genuine non reusable individual earnings. In 2012 the indexes touched once again at 133-134.

The BEA determines REAL based upon PCE. Changing for inflation by the CPI would make the present bubble look larger and I think more precise.

The essential point is the huge divergence in between the procedures keeping in mind that the bubble is a bit downplayed.

Portion Distinction In Between House Costs and Genuine DPI

- 2006: (185-120)/ 120 * 100 = 54.17 Percent

- 2023: (305-169)/ 169 * 100) = 80.47 percent

On a genuine DPI basis, house rates are approximately 80 percent above where they need to be.

Some validate these house rates on the basis of home mortgage rates and price. They are incorrect.

The distinction in between house rates and earnings is truly a procedure of the Fed’s tendency to blow monetary bubbles by keeping rates too low too long.

I will attend to supposed price in a following post.

The Fed Dedicates to a 2 Percent Inflation Target, Thoroughly

On the other hand, please note The Fed Dedicates to a 2 Perc ent Inflat ion Target, Thoroughly

Powell’s Cautions

Here is the essential thing Powell stated today: “ As is frequently the case, we are browsing by the stars under cloudy skies“

And to that I would include, utilizing tools like inflation expectations shown to be completely useless.

For conversation of inflation expectations and Biden’s energy objectives ensured to be inflationary, please see Should the Fed Declar e Defeat and Proceed?

The Fed desires inflation at 2 percent however is unaware how to determine it.

This develops bubbles of increasing amplitude in time. And the middle class diminishes as an outcome.

.